Step Four - Add Deductions

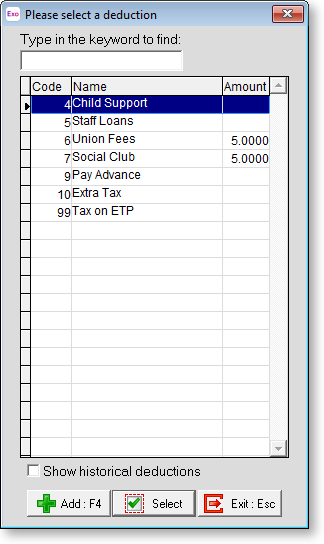

The Deductions Maintenance window lets you create new deductions or alter existing ones. You can also globally load deductions to all employees or a selection of them. Select Step Four from the Payroll Setup Cycle and the following window appears:

The Maintenance menu, which provides access to Deduction maintenance, can also be chosen at any time by pressing F2.

Select a deduction and click Select to edit it, or press F4 or click the Add button to create a new deduction.

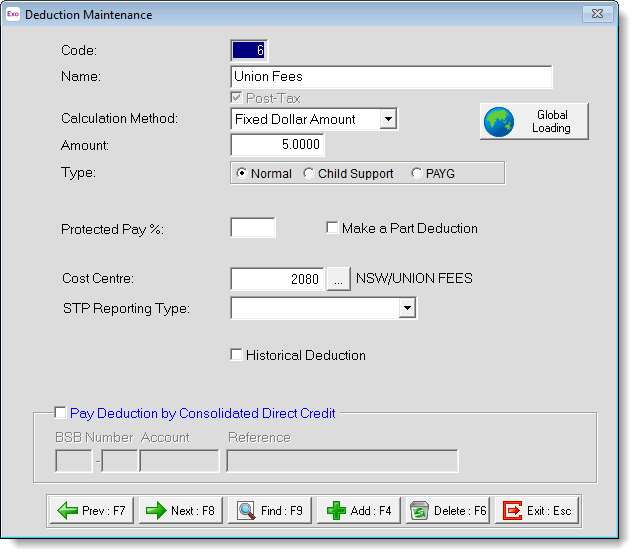

Code Enter the code/number for this deduction. This number can be up to 3 digits in length (1-999).

Name Enter the name you want to call this deduction (up to 20 characters).

Post-Tax The default is to make a new deduction a post-tax deduction (after tax). If you want to make this deduction a pre-tax deduction, de-select this option. This option becomes disabled once transactions exist for the deduction.

Calculation Method Every deduction must have a calculation method that it will use when calculating deductions. This method can be one of the following:

- Fixed Dollar Amount - This means that the deduction is to be a fixed sum, such as a social club deduction of $3.00 per week. If the amount is to be a varying amount depending on the employee, then choose this calculation type and do not enter in any amount in the next field.

- % of Gross Pay - This means that the deduction amount is based on a percentage of the employee's gross pay. This deduction calculation method is used for deductions like superannuation.

- Reducing Balance - This calculation method is for any deduction that is based on an amount of money that is to be deducted in portions from an employee's pay every time they are paid, e.g. staff loans where an amount was borrowed and the employee is to pay that sum back in instalments. The actual amount that is to be reduced is loaded for the particular employee in the employees' Standard Pay window.

Amount/Rate/Percentage Enter the amount, rate or percentage that the deduction you are creating is to use. If the amount, rate or percentage will vary from employee to employee, leave this field blank and type in the particular amount, rate or percentage for the employee in the Standard Pay and Deductions window.

Type Each deduction has its own type. Most deductions are of the normal type but some must be listed as a differing type as they have to be tracked for reporting. Choose from:

- Normal - Use this type for most deductions. Only if a deduction matches the criteria below do you need to change the type from Normal.

- Child Support - If the deduction you are creating is for the purposes of deducting Child Support, then you must choose this type, as this will flag the dollar amount to appear as child support for reporting purposes.

- PAYG - This deduction type is used for making extra PAYG payments, in addition to the PAYG automatically calculated by the system. The extra money will be added to the regular PAYG to form the Total Tax Withheld field of the PAYG Payment Summary.

Protected Earnings Amount If "Child Support" is selected as the Type, you can specify thresholds of protected earnings for multiple pay frequencies (Per Week, Per Fortnight and Per Month). The Protected Earnings Amount (PEA) is an amount that must be left after tax and child support is deducted, to ensure that all of an employee's wages are not deducted for child support payments. Where making the full deduction would take the employee's pay under the PEA, the deduction is reduced to an amount that will leave the PEA.

The PEA is updated at the start of every year. To find out the current rates, go to Services Australia – What the Current Rate Is. You will need to visit this page every year to ensure that the PEA values for all of your "Child Support" Deductions are up to date.

Protected Pay % Tells the system not to make the deduction if the gross pay after the deduction would result in the employee receiving less than the specified percentage of their usual gross. This is for situations where the employee works irregular hours and may not be financially prepared for a large deduction to be made.

Child Support Garnishee This option is available if "Child Support" is selected for the Type. Tick this checkbox for child support payments where a garnishee notice has been issued by the ATO.

Make a Part Deduction If you have chosen to protect a portion of employees' pay, you may also want to say that if an employee does not earn enough gross pay to ensure that the full deduction is being deducted, at least deduct some of it. Select this option to do so.

Cost Centre The Cost Centre for each deduction will automatically default to the employee's own default Cost Centre, which is the one you place against an employee when you add them to the payroll. If you want to cost a deduction to a different Cost Centre, type in the Cost Centre number that you want this deduction to be costed to. Remember that this will override any employee's default Cost Centre.

STP Reporting Type Select the reporting category for this Deduction:

- Non Reportable - Select this option for a deduction that are not required to appear in Single Touch Payroll reporting.

- Fees - Select this option for a deduction that is required to appear in Single Touch Payroll reporting, e.g. union fees.

- Workplace Giving - Select this option for pre-tax deductions to charity donations.

- Salary Sacrifice - Other - if you and your employee agree to salary sacrifice the fees or workplace giving, you must report the amount as salary sacrifice – other employee benefits. Use this option to create a pre-tax deduction that will be reported in STP as salary sacrifice – other employee benefits.

- Child Support - Non Reportable - For child support deductions, you can select this option to exclude child support from your STP report.

Historical Deduction Over a long period of time, you may find that some deduction codes are no longer required. To avoid having to scroll through long lists of unnecessary codes, you can hide obsolete codes from the code lookup screens by marking them as historical. You cannot mark a deduction as historical if it is currently included in employees' Standard or Current Pays. You may reverse the historical setting at any time, making the code current again.

There is an exception to the rule above: you can mark a deduction as historical if the only employees it is associated with are terminated employees; however if a terminated employee is reinstated, any historical records associated with them will be reactivated, i.e. the Historical Deduction option will become disabled.

Pay Deduction by Consolidated Direct Credit This is used to redirect funds from multiple deductions across many employees to a single bank account, e.g. a social club deduction. This option is not available if the deduction is for Employee Super, and the superannuation provider for the deduction has a bank account number stored; in this situation, all funds will be direct credited to the superannuation provider's bank account.

Tick this box to enter an appropriate bank account. This will be processed during the Direct Credit Transfer, along with other wage & salary payments.