The Termination Wizard

The Termination Wizard provides a breakdown of the information that it has gathered in order to calculate the final termination amount.

This amounts to:

Leave outstanding from the previous entitlement periods

+

Leave accruals for the current entitlement period

-

Leave paid in advance of the next entitlement date

Click on the Termination Wizard button at the bottom left of the Current Pay window to begin. The following message appears:

Click Yes to proceed.

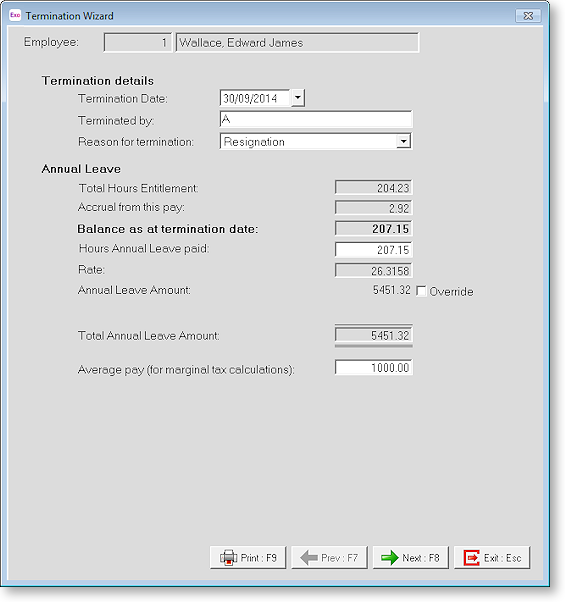

The Termination Wizard opens with the current balance of Annual Leave:

Termination Details

Termination Date Enter the date the employee's employment ceases. The system will use this date to calculate the total leave the employee is entitled to on termination.

Terminated by Enter the name of the payroll person that is processing the termination pay.

Reason for termination Specify the reason for the termination. Choose from:

- Resignation - This is money paid as a result of a normal termination e.g. voluntary resignation.

- Bona Fide Redundancy - This is money paid to an employee who has been laid off, as his/her services are no longer required.

- Approved Early Retirement - This is money paid to an employee who is retiring early as part of an ATO-approved early retirement scheme.

- Invalidity - This is a payment on termination of employment, where the termination has occurred because of mental or physical incapacity. The incapacity does not necessarily have to be total incapacity—it may be incapacity for a particular occupation.

- Other - This category is used if none of the above are suitable, e.g. employment terminated due to wilful misconduct.

Annual Leave

Total Days/Hours Entitlement This equates to hours outstanding + hours accrued in previous pays - hours paid in advance.

Accrual from this pay Hours amassed in this pay.

Balance as at termination date This equates to hours outstanding + hours accrued in previous pays + hours accrued this pay - hours paid in advance, and represents the balance of annual leave days/hours payable on termination.

Days/Hours Annual Leave Paid This defaults to the total entitlement.

Rate This is calculated at the employee's standard daily rate, i.e. from the standard pay, gross earnings liable for annual leave / hours paid.

Annual Leave Amount This is the amount of Annual Leave the employee will be paid on termination. You can change this amount by clicking on the Override button.

Leave Loading Amount If the employee qualifies for leave loading, this field appears, showing the amount of Leave Loading the employee will be paid on termination. You can change this amount by clicking on the Override button.

Total Annual Leave Amount This equates to the hours of annual leave taken multiplied by the rate.

In addition, if leave loading is payable on termination in accordance with the employee's award, an extra percentage will be applied:

For leave accrued after 17/08/1993, for a normal termination: Payments that are made due to a resignation, and which involve unused annual leave and leave loading that accrued since 17 August 1993, will appear in the Gross Amount field of the Payment Summary. These will be taxed according to the employee's marginal tax rate.

For leave accrued after 17/08/1993, and the employee is terminating because of redundancy, retirement or invalidity:

Payments that are made due to redundancy/invalidity/early retirement and that relate to unused annual leave and leave loading, will be placed into the Lump Sum A field within Single Touch Payroll reporting, and will be taxed at 31.5% (including Medicare levy).

Average pay (for marginal calculations) This equates to the gross earnings liable for annual leave, from the employee's standard pay. The marginal calculation takes the difference of the PAYG on the average pay and:

PAYG on (the average pay + (the termination payment factored down to one pay period))

and then factors the result up to an annualised figure.

Once these details are completed, click Next or press F8 to proceed to the next step.

Long Service Leave

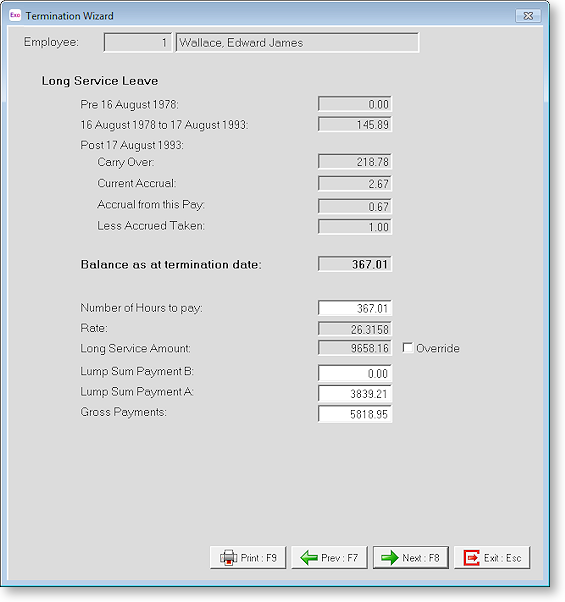

The next page of the Termination Wizard displays the current balance of Long Service Leave:

Pre 16 August 1978 Accruals prior to 16 August 1976 that have not yet been taken by the employee. If you are new to this system it is important to load any entitlements still owing, from your previous records.

16 August 1978 to 17 August 1993 Accruals between 16 August 1976 and 17 August 1993 that have not yet been taken by the employee. If you are new to this system it is important to load any entitlements still owing from your previous records.

Post 17 August 1993 Accruals after 17 August 1993 have not yet been taken by the employee. If you are new to this system it is important to load any entitlements still owing, from your previous records.

Carry Over This is the balance carried over from previous entitlement years.

Current Accrual Hours amassed since the start of the accrual period, to which the employee will be entitled upon the next rollover. This field is automatically calculated by the Payroll.

Accrual from this Pay Hours amassed in this pay.

Less Accrued Taken Hours of leave paid in advance.

Balance as at termination date This equates to hours outstanding + hours accrued - hours paid in advance, and represents the balance of long service leave hours payable on termination.

Number of hours to pay This will default to the current balance. You may elect to alter this in order to match the value of Leave Outstanding, if the employee's award stipulates that only outstanding long service leave is payable on termination.

Long Service Amount This equates to the number of hours to pay multiplied by the rate.

Lump Sum Payment B (For leave accrued before 16/08/1978) There is specific tax treatment for long service leave that has accrued before 16 August 1978. If there are still untaken days that accrued before this cut-off date, enter an appropriate amount for those days into this field.

This part of the long service leave payout will in turn appear in the Lump Sum B section of the employee's PAYG Payment Summary. Only 5% of the amount entered here is actually classified as “assessable income”. Therefore, the PAYG on this payment will equate to 5% of the amount taxed at the employee's marginal tax rate.

Lump Sum Payment A This applies to two cases:

For leave accrued between 16/08/1978 and 17/08/1993: There is specific tax treatment for long service leave that has accrued between 16 August 1978 and 17 August 1993. If there are still untaken days that accrued between this period, enter an appropriate amount for those days into this field.

This part of the long service leave payout will in turn appear in the Lump Sum A section of the employee's PAYG Payment Summary. Therefore, the PAYG on this payment will be at a flat rate of 31.5% (including Medicare) of the amount entered here.

For leave accrued > 17/08/1993 and the employee is terminating only because of redundancy, retirement or invalidity: The balance of the long service leave payout will be taxed at a flat rate for employees who are being terminated due to one of these reasons.

This part of the long service leave payout will in turn appear in the Lump Sum A section of the employee's PAYG Payment Summary. Therefore, the PAYG on this payment will be at a flat rate of 31.5% (including Medicare) of the amount entered here.

Salary, Wages, Bonus etc (For leave accrued > 17/08/1993, for a normal termination) The balance of the long service leave payout will be taxed at the employee's marginal tax rate, and will appear in the Gross Payments section of the employee's PAYG Payment Summary.

Once these details are completed, click Next or press F8 to proceed to the next step.

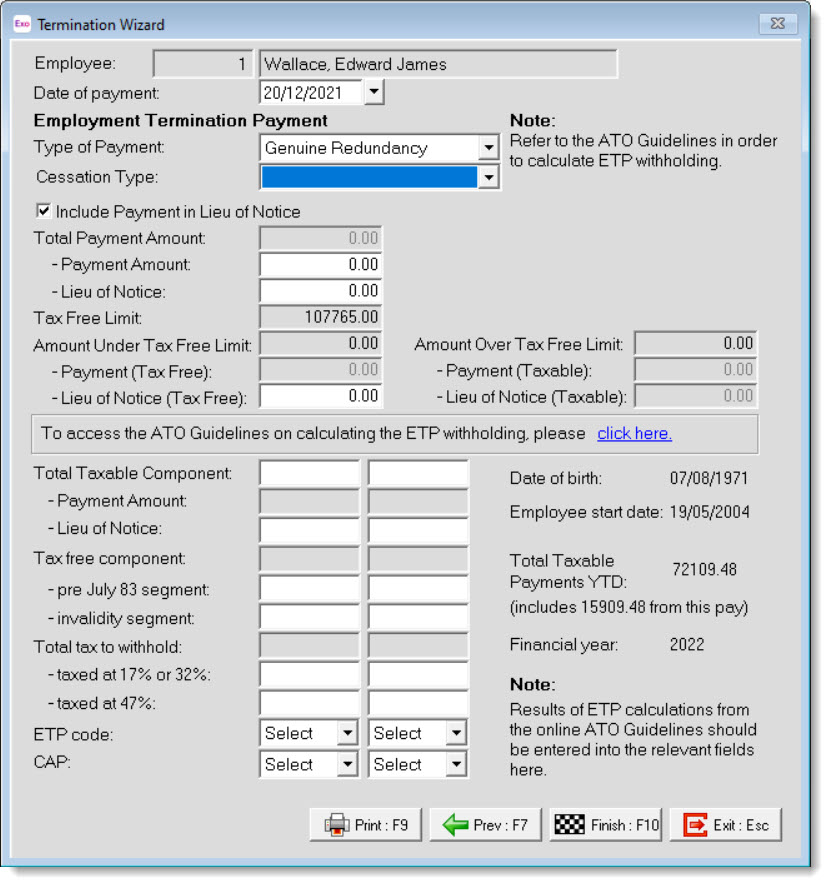

Employment Termination Payment

This page holds the information necessary for termination payments. For taxable termination payments, see the ETP guidelines on the ATO website to work out the values and codes to enter on this page. (A link to this page is also available in the Help menu.)

The ATO requires that if more than one ETP code applies to a termination payment, a separate payment summary record must be made for each code. Two separate payment summary records can be specified on this page, each with a different ETP Code.

Date of payment Enter the last working day for this employee. This will default to the physical payment date of the current pay.

Type of Payment Select the type of termination payment. The payment type selected affects the properties below. Choose from:

- Other

- Genuine Redundancy

- Early Retirement Scheme

- Death Benefit - Dependant

Cessation Type With the introduction of STP Phase 2 in January 2022, the ATO now collects data that was previously reported to Centrelink via an Employment Separation Certificate. One of the data items the ATO now needs to collect for the Department of Services is a cessation reason. Choose from:

- V - Voluntary

- I - Ill-Health

- D - Deceased

- R - Redundancy

- F - Dismissal

- C - Contract Cessation

- T - Transfer

Include Payment in Lieu of Notice Payments in lieu of notice are liable for superannuation. If this option is ticked, extra Lieu of Notice fields become available, allowing you to enter details of the Lieu in Notice portion of the termination payment separately. When the Employment Termination Payment is generated, Allowances will be created in the employee's pay with the type "TFT Lieu of Notice" and "ETP Lieu of Notice"; these Allowances can be made liable for Superannuation.

Total Payment Amount Enter the total amount of the termination payment. See How to complete the PAYG payment summary - employment termination payment form on the ATO website if you are not sure what to include in the termination payment amount.

Tax Free Limit This field displays the tax free limit on termination payments of the selected type. The Amount Under Tax Free Limit and Amount Over Tax Free Limit fields show how much of the Total Payment Amount falls under the limit and how much is above. For some termination payment types, only the amount over the limit is used in the ETP calculation.

Total Taxable Component Enter the ETP amount that has tax withheld from it. If the Include Payment in Lieu of Notice option is ticked, this amount is split into a Payment Amount and a Lieu of Notice amount.

The Total Taxable Component is not liable for Superannuation Guarantee (SG). It can include amounts that relate to payment in lieu of unused Sick Leave, which fall outside the definition of Ordinary Time Earnings (OTE) - refer to Superannuation Guarantee Ruling SGR 2009/2. The Ruling contains a table of examples as a general guide to the sort of payments commonly paid to employees during the course of employment. Under the heading "Termination Payments", the table shows that payment in lieu of notice are included as OTE for the purposes of SG. It should also be noted that in the Ruling, redundancy payments, ETP payments for sick leave in lieu of notice, lump sum annual leave, and lump sum pro rata long service leave payments on termination are not included in OTE for SG purposes. When splitting the Total Taxable Component (by ticking the Include Payment in Lieu of Notice option), take care to ensure that payments that are in lieu of notice are in the Lieu of Notice field (attracting SG), while values that are entered into the Payment Amount field are respecting OTE classifications in accordance with SGR2009/02, as SG will not be calculated on those payments.

Tax Free component Enter the ETP amount that does not have tax withheld from it. This is split into separate segments - the ATO website will tell you how much to put in each segment.

Total tax to withhold Enter the amount of tax to be withheld from the ETP. This is split into separate components - the ATO website will tell you how much to put in each component.

ETP code This code specifies the reason for the payment. The code must be unique to each column. Choose from:

- R - payment made due to retirement, redundancy, invalidity or compensation for personal injury, unfair dismissal, harassment or discrimination.

- O - payment for reason not covered by R, e.g. golden handshake, gratuity, payment in lieu of notice, payment for unused sick leave, payment for unused rostered days off.

- D - a death benefit ETP paid to a dependant of the deceased.

- N - a death benefit ETP paid to a non-dependant of the deceased.

- T - a death benefit ETP paid to a trustee of the deceased’s estate.

CAP Choose the ETP cap that applies to the payment. Two options are available: the standard, indexed ETP cap and the non-indexed Whole of income cap. The ETP cap applies in most cases. The Whole of income cap applies to only records where the ETP Code is "O" - in these cases, use the lower of the existing ETP cap and the "whole of income" cap.

Click Finish or press F10 to complete the Termination Pay and return to the Current Pay window. The Termination Wizard button changes to Undo Termination for this employee.

You can click the Undo Termination button if you decide not to proceed with the employee's termination pay. You will be asked to confirm this. Click Yes to undo the termination process. Another message will appear, reminding you to zero all of the leave payments for the employee's pay.

Once the employee's termination is finalised, their Exo Payroll employee record remains. They can be reinstated by clicking the Reinstate button on the Employee Management window.