Standard Pay - Non-Cash Benefits

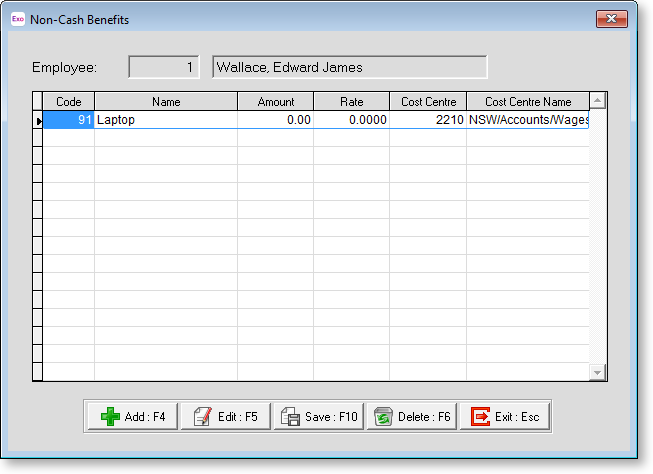

Non-Cash Benefits are loaded in one-by-one to complete the benefits required for the employee's total salary package per pay period. To enter standard pay deductions select the Non-Cash Benefits button on the left of the Standard Pay tab.

If you want to set up a completely new benefit or alter the structure of an existing benefit, you can press F2 to open the Maintenance window. Choose Non-Cash Benefits to create the deduction without having to exit from the employee file.

To add a new benefit click on the Add button or press F4. The following window appears:

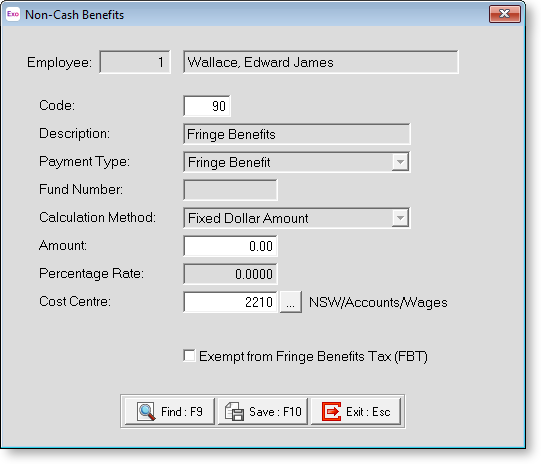

Most of the details on this window cannot be edited, as they are derived from the Non-Cash Benefits masterfile.

Code If you know the code for the benefit you want to enter against an employee, enter the code and press enter to continue. If the benefit code entered does not exist, a list of available codes will appear. Select the code required then click on it or press enter. You can also press F9 or click Find for the list of codes.

Description The name derived from the Non-Cash Benefit masterfile.

Payment Type The type of payment derived from the Non-Cash Benefit masterfile.

Calculation Method The transaction calculation method derived from the Non-Cash Benefit masterfile.

Amount This field is only available if there is a dollar value to be entered for this benefit. Enter the amount to be deducted and then press enter to continue. This field will only be able to be edited if there has been no amount setup in the Non-Cash Benefits masterfile.

If the amount is for a Fringe Benefit, enter the taxable value of the benefit, prior to any FBT or GST-related Gross Up calculation.

Percentage Rate If the benefit has a fixed rate it will appear here.

Cost Centre Use this field to enter the Cost Centre number if it is different from the employee's default Cost Centre.

Exempt from Fringe Benefits Tax (FBT) This option is available for Fringe Benefits, if the company is exempt from FBT (as determined by the options on the Employer details section of the Setup Payroll window). When an employer is exempt from FBT, it is still possible for employees for an employee to perform some duties that are exempt from Fringe Benefits Tax, and some duties that are not. You can edit this option to control whether or not individual Fringe Benefits are exempt from FBT.

Once you have completed this window click Save or press F10 to save and return to the Non-Cash Benefits window. If further deductions are to be loaded for this employee, click Add or press F4 and repeat the process until all the deductions have been entered.