Other Setup

The Other Setup section of the Setup Payroll window contains additional settings that affect the operation of MYOB Exo Payroll. There are also options to enable certain advanced features, which would otherwise remain concealed. Settings are divided across the following sub-sections:

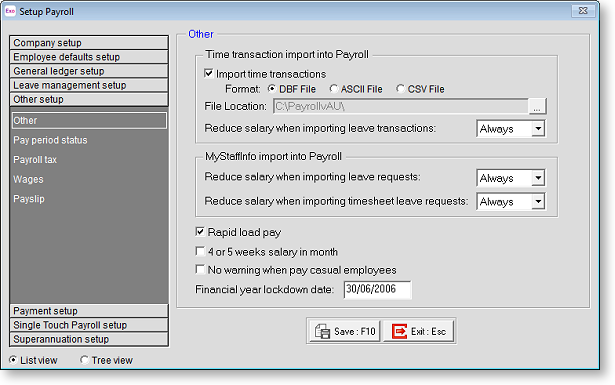

Other

Import time transactions Selecting this option allows you to import a time attendance file from an outside time and attendance software program. This program, such as MYOB Exo Time and Attendance or MYOB Exo Business, combined with an electronic time clock creates a file that then loads all employee hours and what allowances they are entitled to for that pay period.

If this options is selected, you must specify the format of the import file that will be created by the time and attendance program - choose between DBF, ASCII and CSV formats.

If you are going to import time transactions from MYOB Exo Business, this option must be enabled, and the CSV format must be selected.

File Location If the Import time transactions option is selected, you must specify the location where the import files are stored.

Import files can also be placed in the root install directory (usually C:\Payrollv).

Reduce salary when importing leave transactions Specify how the system should behave with regard to reducing salary when importing leave via the import time transactions function:

- Always reduce salary.

- Never reduce salary.

- Display a prompt to the user, asking if they want to reduce salary.

MyStaffInfo import into Payroll These properties are only available if the MYOB MyStaffInfo product is installed. When importing leave requests from MyStaffInfo, specify how the system should behave with regard to reducing salary:

- Always reduce salary.

- Never reduce salary.

- Display a prompt to the user, asking if they want to reduce salary.

Two properties are available: one to specify behaviour for imported leave requests, and one for imported timesheet leave requests, i.e. timesheet transactions where the Type is "Leave".

Rapid Load Pay Selecting this option enables the Other0 module in the Pay menu. Rapid loading is a method of entering pay period details that vary pay-period-by-pay-period. It allows for speed loading of transactions that go into making up employees' pay rather than copying the standard pay into the current pay.

4 or 5 weeks salary in month Selecting this option will enable you to pay salaried employees as a 4 or 5 week month. When you create a monthly pay with this option selected, the Other1 will ask you how many weeks are in this pay month.

If you use this option, when you load the standard pay for monthly salaried employees you must divide their annual salary by 52, and enter this amount (the Payroll will multiply this amount by either 4 or 5, as per your specifications). You should also never alter the tax rate, as the Payroll calculates it correctly and if you make any changes you are in danger of understating an employee's yearly earnings, so that the employee would be underpaying their PAYG for the year.

No warning when pay casual employees When paying a casual employee, Exo Payroll shows a warning message stating that the employee is a casual employee and asking you to confirm that you want to pay them this pay period. This warning can become unnecessary if you are paying casual employees regularly or paying a large number of casuals. Selecting this option means that this warning message no longer appears.

Financial year lockdown date To prevent users from creating pays in previous financial years, either by mistake or deliberately, you can enter a date in this field. The system will not allow you to create any pays prior to this date.

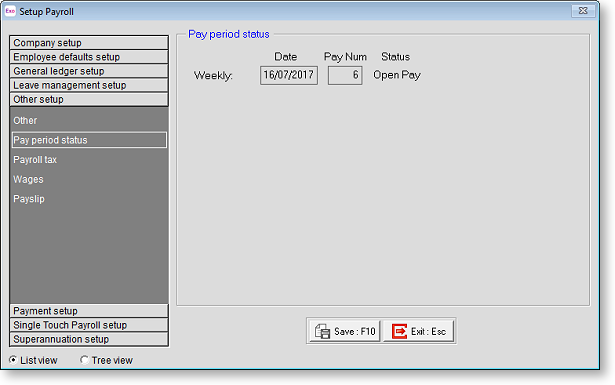

Pay period status

The fields in this sub-section are automatically derived from payroll activity. This involves current pay period dates for all of your pay frequencies, and their corresponding pay numbers. Every time you open a new pay period it is given a new number, starting at 1 and increasing. This window also shows if the pay period is still open or has been updated.

You are unable to match pay numbers to pay weeks, as this is unnecessary when you are able to report on any given date period and for any given pay number.

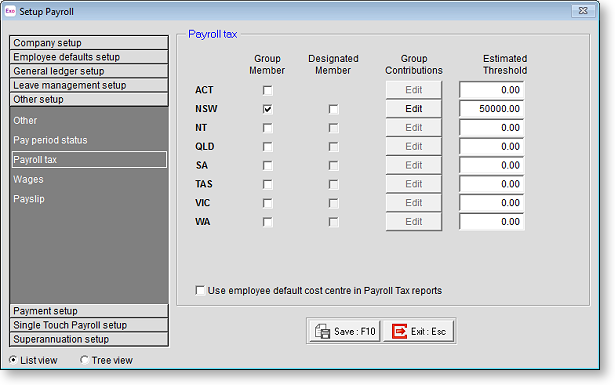

Payroll tax

Payroll tax is a tax charged by the State Government, calculated on the payroll size of a business.

Exo Payroll is programmed with the latest rates and thresholds for each state. If necessary, you can override the rate and threshold on the Other2 section of the Setup Payroll window.

Group Member If the company is a member of a Payroll Tax Group, you need to set up the contributions paid in each state. Tick the option for each state in which there is a group member.

Designated Member If this company is the designated member, tick the option(s) for the state(s) in which the company is the designated member.

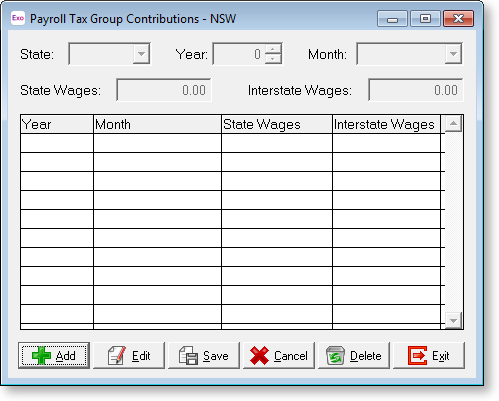

Group Contributions In order for the system to correctly calculate the group payroll tax, you must enter the group contributions for each group member every month. Click the Edit button. The following window appears:

The grid lists all the group contributions have you entered into the system. To enter a new contribution:

Click the Add button.

The State field will default to the state for which you are entering group contributions.

In the Year field, select the year for which you are entering group contributions.

From the Month dropdown list, select the month for which you are entering group contributions.

In the State Wages field, enter the total wages paid by other group members in the same state. You should exclude contributions paid by this company in the state as the system will automatically calculated it from the pays entered into the system.

In the Interstate Wages field, enter the total wages paid by group members in other states.

Click the Save button.

You must repeat these steps every month to enter the group contributions. The system requires this information to correctly calculate group payroll tax.

Estimated Threshold Payroll tax applies to companies earning above an annual wage threshold, which differs by state. Exo Payroll stores the current thresholds for all states and applies them when generating Payroll Tax reports. You can use these fields to override the threshold for each state if necessary; the overridden threshold will be used on Payroll Tax reports. If the Estimated Threshold is set to 0.00, the default threshold will be used.

Use employee default cost centre in Payroll Tax reports If this option is ticked, the Other3 will determine the state that earnings apply to by using the Other4 of the related employee. If it is not ticked, the reports will use the Cost Centre on the earnings themselves.

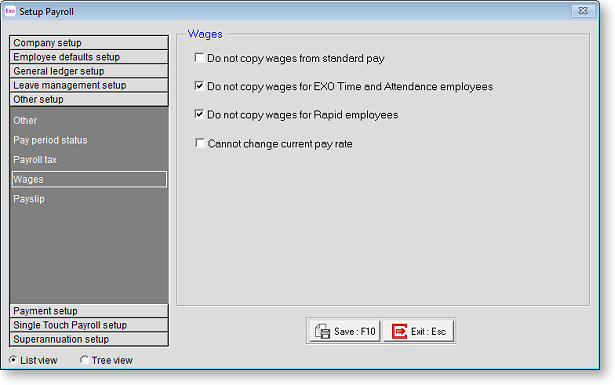

Wages

Wages are paid to non-salaried employees, at a set rate per hour, multiplied by the Pay Rate Multiplier that is defined in the Other5 section.

Do not copy wages from standard pay Selecting this option means that when you create the Other6, the wage lines in an employee's Other7 will not be copied into the Current Pay. (Everything else will, just not the contents of the Other8.) This is to ensure that you do not double up wage/hours information from the Standard Pay with wages from some outside source such as MYOB Remote or Timesheet.

Do not copy wages for Exo Time and Attendance employees Selecting this option means that when you create the Other9, the wage lines in an employee's Pay period status0 will not be copied into the Current Pay if they have been tagged as a Time and Attendance employee. (Everything else will, just not the contents of the Pay period status1.) This is only to be switched on if you are entering current pay information via MYOB Exo Time and Attendance. It is to ensure that you do not double up wage/hours information with what may be in the employee's Standard Pay.

Do not copy wages for Rapid employees Selecting this option means that when you create the Pay period status2, the wage lines in an employee's Pay period status3 will not be copied into the Current Pay. (Everything else will, just not the contents of the Pay period status4.) This should only be selected if you are entering current pay information via Pay period status5 or an electronic time clock. It is to ensure that you do not double up wage/hours information with what may be in the employee's Standard Pay.

Cannot change current pay rate Selecting this option means that after creating your Current Pay, you are unable to change an employee's hourly rate when editing that Current Pay. This is to be used as a safeguard against an error being made in a Current Pay and someone accidentally changing an employee's hourly rate and processing the pay without noticing the error has been made. If there may be a reason to change an hourly rate while you are doing a Current Pay then leave this option off.

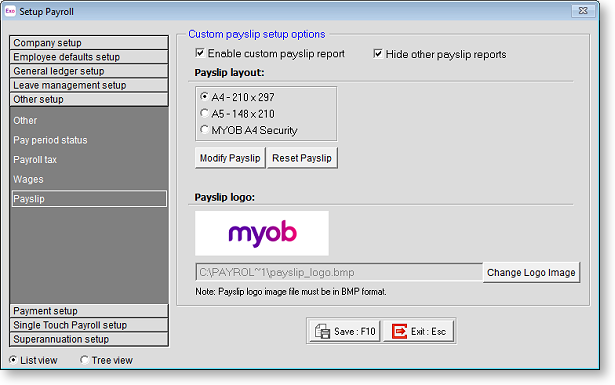

Payslip

This section lets you enable, set up and edit the Pay period status6.