ANSWER ID:13145

Payroll will not automatically calculate back pay as there are too many variables. If you need to pay an employee back pay, you'll need to determine the back pay amount, create a back pay pay code, then process the back pay.

1. Determine the back pay amount

To determine the gross pay owing to the employee:

Determine the employees current rate of pay.

Determine the employee's old rate of pay.

Determine the rate difference by subtracting the old pay rate from the current pay rate.

Multiply the rate difference by the number of hours/days owing to the employee.

2. Create a pay code for back pay

Once you have determined the gross difference to be paid to the employee:

- Go to the Maintenance command centre and click Maintain Pay Codes.

- Check the list of pay codes for one called Back Pay.

If it already exists, do nothing.

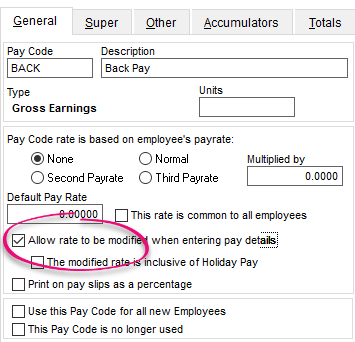

If it doesn't exist, click New to create it. - For the Pay Code Type, select Gross Earnings.

- For the Pay Code enter BACK.

- For the Pay Code Description enter Back Pay.

- Click Ok.

- Select the option Allow rate to be modified. This allows you to enter the back pay amount on the employee's pay.

- Click Close.

3. Process the back pay

Go to the Prepare Pays command centre and click Enter Pays.

Double click the employee.

Click Add Default, select the Back Pay pay code and click OK.

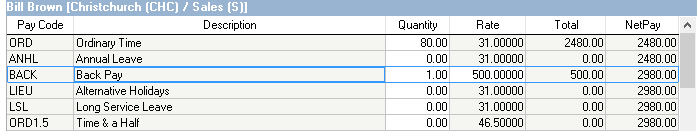

In the Quantity column enter a 1, and enter the total gross back pay in the Rate column.

In this example the total back pay is $500 (Rate) and will be paid 1 time (Quantity).

Click Tax Override.

- Enter the back pay amount into the Extra Pay Amount field.

- Select the appropriate tax code based on the employee's annual income, then click Ok.

Tax codes:

SB: 0 to $14000

S: $14000 to $48000

SH: $48001 to $70000

ST: more than $70000 Process the rest of the pay as normal.