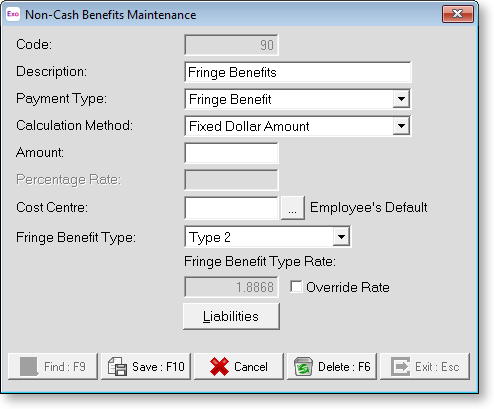

Non-Cash Benefits

The Non-Cash Benefits section of the Non-Cash Benefits window allows to you add extra items to an Employee's salary package such as fringe benefits, salary sacrifice and employer super contributions, without affecting the employee's net pay (cash remuneration).

The Maintenance menu, which provides access to Non Cash Benefit maintenance, can also be chosen at any time by pressing F2.

When you first enter the this window all the fields are blank with the exception of the Code field. This allows you to either enter the code for a new Non-Cash Benefit record or enter the code of an existing record to edit it.

Code Enter an unused Non-Cash Benefit Code to add a new record.

Description Enter a name for this Non-Cash Benefit.

Payment Type Select the type of payment. Choose from:

- Fringe Benefit - such as a cellular telephone, pager, fuel card, etc.

- Salary Sacrifice - Other - if the employee is sacrificing part of their salary in exchange for some generic type of non-cash/fringe benefit, not involving Superannuation, select this option.

Calculation Method Select how benefits will be calculated. Choose from:

- Fixed Dollar Amount - Select this method and enter a dollar amount for how much the Non-Cash Benefit is worth.

- % of Gross Pay - Select this method in order to value the Non-Cash Benefit as a percentage of the gross pay.

Amount Enter a standard dollar amount that will be inserted into the pay whenever this Non-Cash Benefit is applied. Leaving the Amount at zero lets you assign the dollar amount at the time of payment for individual employees.

If the amount is for a Fringe Benefit, enter the taxable value of the benefit, prior to any Gross Up calculation (see the Fringe Benefit Type setting below for details on how the system will automatically Gross Up fringe benefits for reporting in Single Touch Payroll and Payroll Tax reports).

Percentage Rate Value the Non-Cash benefit as a proportion of the gross pay.

Cost Centre The Cost Centre for each non-cash benefit will automatically default to the employee's own default Cost Centre which is the one you place against an employee when you add them to the payroll. If you want to cost a non-cash benefit to a different Cost Centre, type in the Cost Centre number that you want this Non-Cash Benefit to be costed to. Remember that this will override any employees' default Cost Centre.

Fringe Benefit Type The setting for Fringe Benefit Type is only available for Non-Cash Benefits which are Fringe Benefits, and has a Fringe Benefit Tax implication. For Fringe Benefits, only the pre-Grossed Up value (exclusive of fringe benefit tax) is entered into the Amount field.

In the situation of an FBT-inclusive value being required on a report, the transacted amount will be multiplied by either a Type 1 or Type 2 rate, in order to arrive at a grossed-up value.

In the situation of an FBT-exclusive value being required on a report, the transacted amount will be displayed on the report.

- Type 1 - If the employer is entitled to an input tax credit for this fringe benefit under the GST legislation, the fringe benefit is classed as a "type 1" benefit, and is grossed up by 2.0802 for FBT purposes.

- Type 2 - If the employer is not entitled to an input tax credit for this fringe benefit under the GST legislation, the fringe benefit is classed as a "type 2" benefit, and is grossed up by 1.8868 for FBT purposes.

Override Rate If you want to calculate the FBT at a different rate, you can select this option and enter a different rate.

STP Reporting Type: Salary Sacrifice Select this checkbox to report other employee benefits to the ATO.

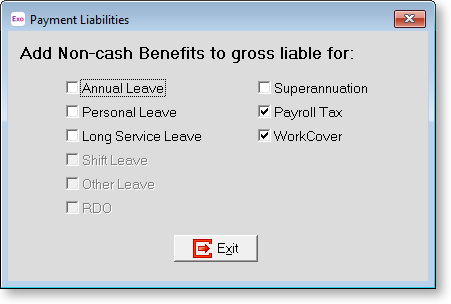

Liabilities Certain Non-Cash Benefits have an effect on other payment items, e.g. salary sacrifices other than Superannuation may be liable for Superannuation. Clicking this button opens a window that lets you select the pay items this allowance is liable for.

Once you have made your additions or alterations, click Save or press F10 to save, then press esc to return to the Non Cash Benefits Setup window.