Payroll multi-branch GL

MYOB Acumatica — Payroll offers support for systems that are set up with multiple branches. The General Ledger journals that are generated by the Payroll module when a pay run is processed take employees’ branches into account: a separate GL batch is created for each branch involved in a pay run. This makes it possible to set up pay groups containing employees from multiple branches and process pay runs for them.

While the processing of pay runs supports multiple branches, multiple branch support has not yet been implemented for Payment Summaries (AU only) or TFN declarations (AU only). Support for these processes will be added in later releases.

Setup

New configuration options and validations have been added to support this feature.

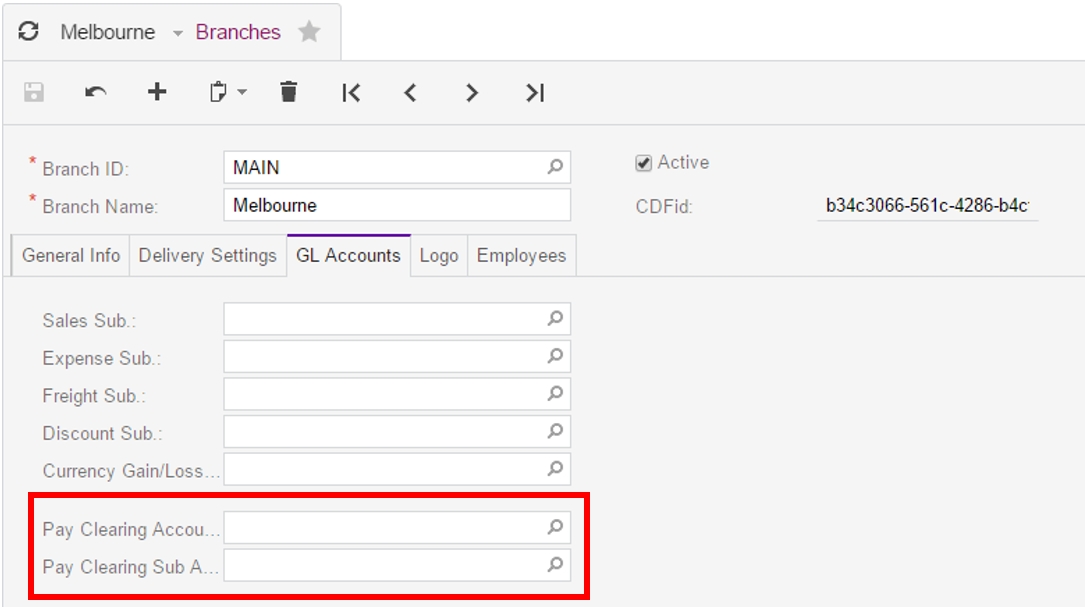

Branches

The Pay Clearing Account and Pay Clearing Sub Account fields on the GL Accounts tab of the Branches form (CS.10.20.00) let you specify the accounts to use for GL journals generated for that branch:

If no accounts are specified here, the system will use the default clearing accounts specified on the Payroll Preferences form (MP.PP.11.00).

Properties are available in the Summary area of the Branches form to aid in reporting—see Reporting.

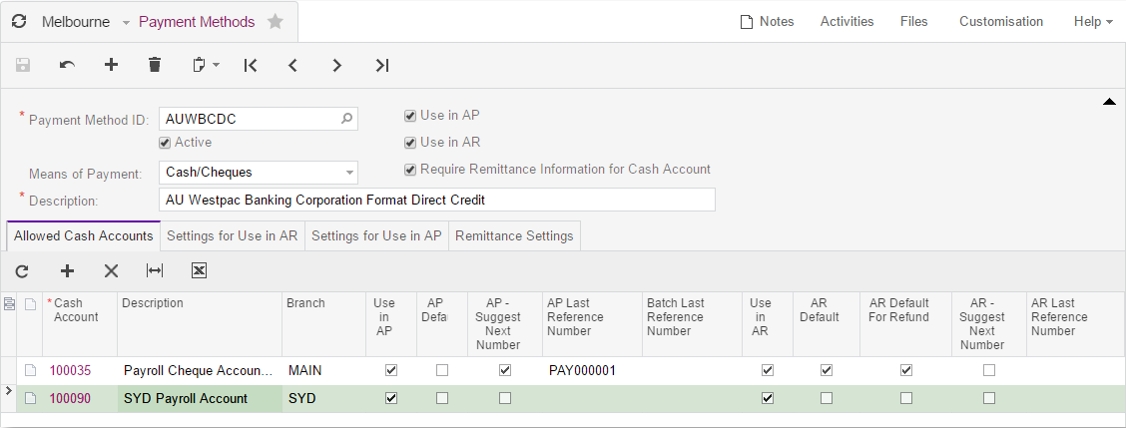

Payment methods

Payment methods can be associated with multiple cash accounts on the Allowed Cash Accounts tab of the Payment Methods form (CA.20.40.00):

For each payment method that will be used with the payroll system, add a cash account associated with each branch that payroll employees belong to.

Any cash accounts added on this form that are going to be used with the payroll system must have the Use in AP checkbox ticked.

When the system needs to determine which cash account to use for any transaction, it takes the relevant employee’s branch and uses the payment method to find the cash account associated with that branch.

Superannuation funds

Prior to the 2016.1.11 release of MYOB Acumatica, it was necessary to set up a separate Superannuation Fund record for each branch involved in a pay run—this is no longer the case. As superannuation funds are associated with a payment method, and payment methods can be associated with multiple, branch-specific cash accounts, a single superannuation fund record can process superannuation payments to employees from multiple branches.

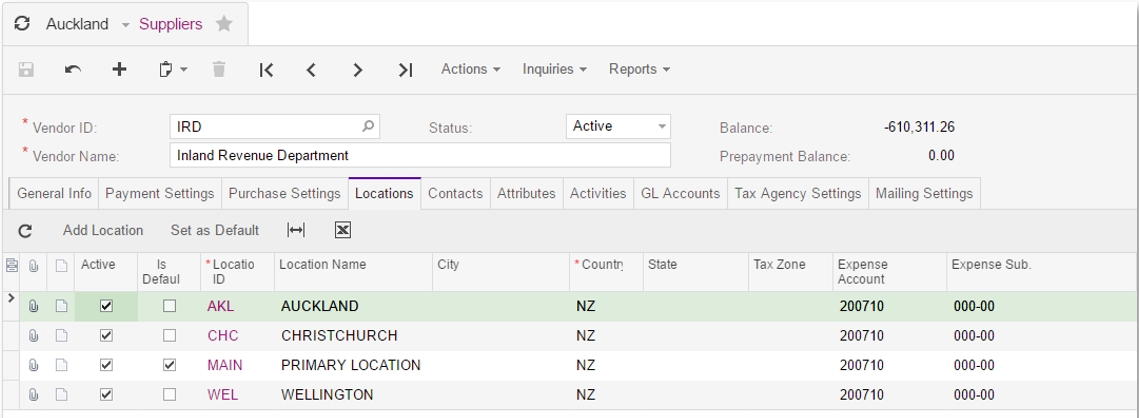

IRD supplier (NZ only)

When the IR345 return is processed (see IRD reporting), the system creates a separate Payment Batch for each of the different branches involved. The payment batches are created against the “IRD” supplier that is available by default for all NZ companies, and involve debiting an Accounts Payable account and crediting a matching Cash account.

Cash accounts in MYOB Acumatica are branch specific—this means for every branch that is involved in the IR345, a cash account needs to be set up for the IRD supplier. You can set up multiple cash accounts for the IRD supplier, by adding a location for each branch on the Locations tab of the Supplier form (AP.30.30.00).

For this tab to be available, the Business Account Locations feature must be enabled on the Enable/Disable Features form (CS.10.00.00).

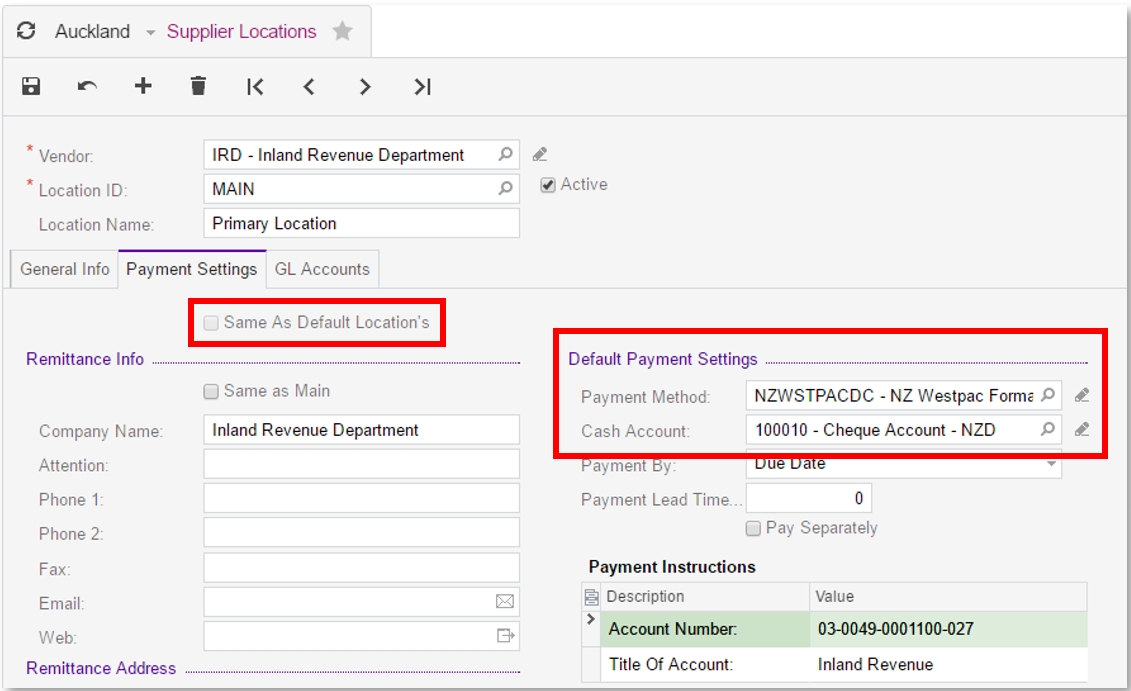

For each location, configure the following settings on the Payment Settings tab of the Supplier Locations form (AP.30.30.10):

Untick the Same As Default Location’s option

Select a Payment Method and Cash Account that relate to the selected branch.

For this form to be available, the Business Account Locations feature must be enabled on the Enable/Disable Features form (CS.10.00.00).

Processing pays

GL batches

When processing a pay run, the system determines the branches of all employees in the pay run and creates a GL batch per different branch that is involved in a single pay run. This means that a pay run can result in multiple GL batches.

For example, if a pay run involves two employees, one belonging to AKL branch and the other belonging to WEL, there will be two GL batches created: one for AKL and one for WEL.

Payroll clearing journals

The system uses the following logic to create the Payroll Clearing journal entry when a Pay Run is completed:

Determine the branch of the employee and look up the branch settings to see if the Payroll Clearing account settings are specified for that branch (see Branches). If so, use those settings.

Otherwise, use the Payroll Clearing account settings from the Payroll Preferences form (MP.PP.11.00).

Superannuation

When a pay run is completed, superannuation transactions are created using the cash accounts set up in the superannuation fund’s payment method (see Payment methods).

For example, a superannuation batch is created for the following transactions:

Andrew in “AKL” branch for supplier AMP using cash account CA001 worth $150

Simon in “WEL” branch for supplier AMP using cash account CA002 worth $280

Since there are two different cash accounts involved (one for each branch) there would be two separate payment batches created for this superannuation batch:

One for $150 with AMP supplier and CA001 cash account, and when that payment batch is exported, it will generate the following journal entries:

DR | AMP Accounts Payable (AKL) | $150 |

CR | Cash Account CA001 (AKL) | $150 |

Another for $280 with AMP supplier and CA002 cash account. When this payment batch is exported, it will generate the following journal entries:

DR | AMP Accounts Payable (WEL) | $280 |

CR | Cash Account CA002 (WEL) | $280 |

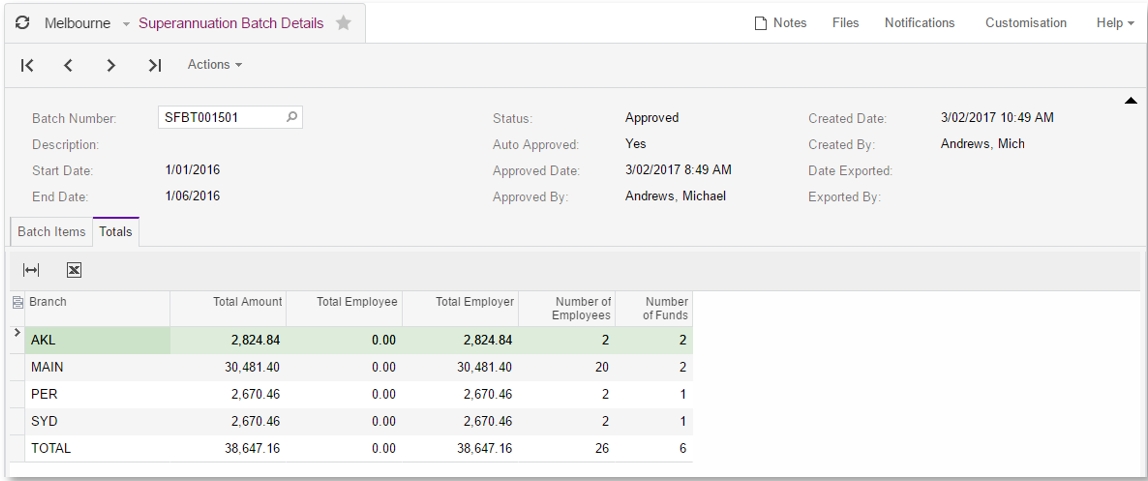

To account for multiple branches associated with one superannuation fund, the Totals tab on the Superannuation Batch Details form (MP.PP.50.06) breaks down the totals by branch:

When exporting superannuation files for a batch, the system produces separate export files for each branch.

Payroll tax (AU only)

No special considerations are required when processing Payroll Tax in a multi-branch environment. Payroll Tax is set up for each state, and each state is assigned a branch—all journal entries created for a Payroll Tax batch are created against the branch that was assigned to that state, as opposed to the branch(es) against the employee transactions.

Reporting

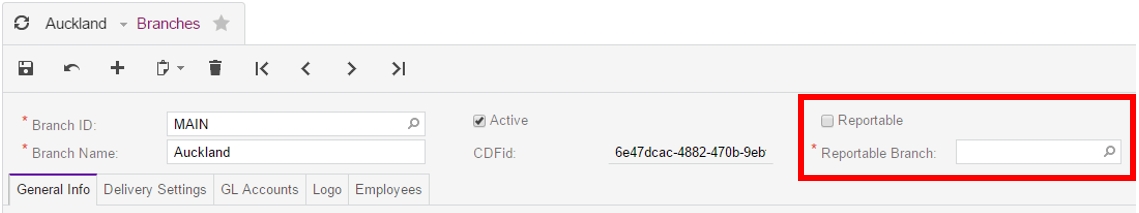

Two fields in the summary area of the Branches form (CS.10.20.00) let you set up parent-child relationships, so that you can group branches for reporting:

• The Reportable option can be ticked to indicate that the branch is a parent branch that can be reported on. Reporting on this branch will include all of its child branches.

• The Reportable Branch field lets you specify a parent branch that the branch is grouped under.

These options are mutually exclusive—if the Reportable option is ticked, the Reportable Branch field is not available and if a reportable branch is chosen, the Reportable option is disabled.

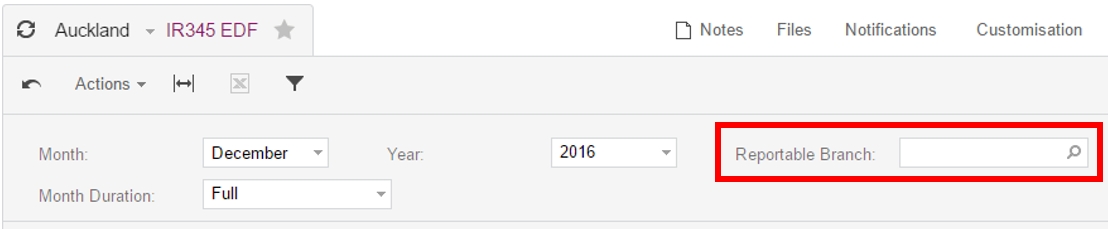

IRD reporting (NZ only)

When generating an IR345 file, you can select the branch to report on:

Only branches that have the Reportable option ticked are available for selection. The selected branch can be a parent branch with multiple child branches—the system creates a separate payment batch for each branch reported on.

Consider the following example an employee belongs to the AKL branch and has the following components in their pay:

Salary $1,000

PAYE $200

KiwiSaver Employer $30

KiwiSaver Employee $30

Student Loan $150

When the employee’s pay is completed, the system would generate the following journal entries (note the branch against all the journal entries):

DR | Salary Expense (AKL) | $1,000 |

|

CR | IRD supplier Accounts Payable (AKL) |

| $200 |

CR | IRD supplier Accounts Payable (AKL) |

| $30 |

CR | IRD supplier Accounts Payable (AKL) |

| $30 |

CR | IRD supplier Accounts Payable (AKL) |

| $150 |

From this pay, for the IR345, the PAYE, Student Loan and KiwiSaver deductions will be included as the employer needs to forward the money collected from the employee to the IRD. This means making a payment to a supplier—the supplier in this case is the IRD supplier that is set up by default in all NZ companies.

When the payment batch is exported, it creates the following journal entries:

DR | IRD Supplier Accounts Payable (AKL) | $410 |

|

CR | IRD Supplier Cash Account (AKL) |

| $410 |

As we can see, since we credited the IRD supplier account to record the liability, when we make the payment we need to debit the same account to record that the liability has been reduced. Also, when we reducing the liability, we need to ensure that we use the same branch that the liability was originally recorded against—the system uses the cash account set up for the relevant location in the IRD supplier record (see IRD supplier).