Extra pay taxation

The Payroll module of MYOB Acumatica calculates PAYG withholding tax on extra payments included in each pay run. The tax calculation can be complicated by the fact that employees can be included in multiple pay groups, and therefore multiple pay runs in overlapping periods. Care must be taken when setting up and using pay items for extra payments, to ensure that employees are taxed correctly.

This page applies to the taxation of extra pays in Australian companies.

Extra pay taxation method

MYOB Acumatica uses Method A for calculating the tax on extra pays. (See Appendix 1: Method A for details on the Method A calculation.) Method A uses two components to calculate tax:

Average gross earnings (the base)

Duration (number of pay periods) that the additional payment is being apportioned across to calculate the additional tax. By default, earnings are averaged across the last 12 months, but if the extra pay applies to a specific date range, then that date range is used instead.

The configuration options applied to extra payment pay items determine what will be included in the average gross earnings, and the number of periods that the tax will be calculated over. A range of configuration options are available to cover all possible cases.

Setting up extra pays

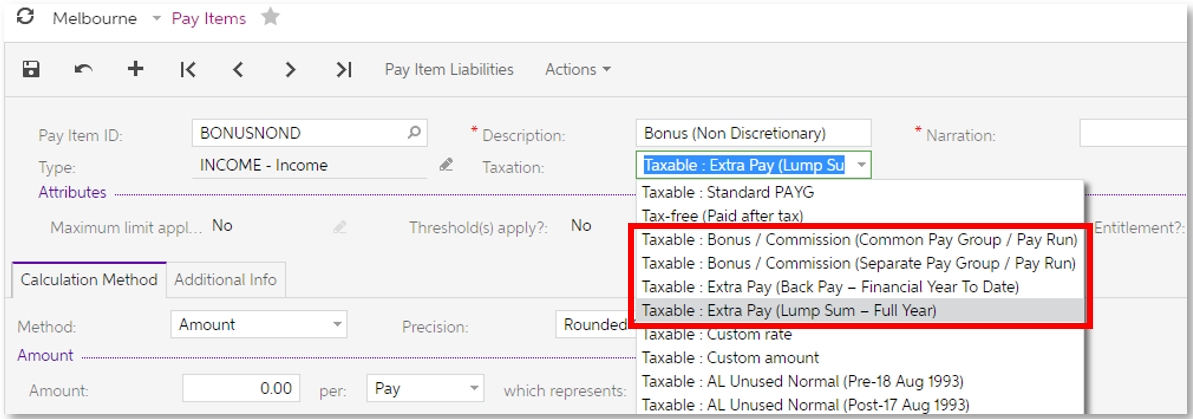

Extra pays are set up as pay items on the Pay Items form (MP.PP.22.10). To ensure that an extra pay will be taxed correctly, it is important to select the correct option from the Taxation dropdown.

The “Taxable: Standard PAYG” option is not appropriate; when this option is selected, the system only looks at the income in the Current Pay. If the extra pay is being made in a separate pay run from normal earnings, then these earnings will be missed and the employee will be undertaxed.

If the extra payment is in the same pay run as normal earnings, every pay run, then the “Taxable: Standard PAYG” option can be used—in this case it isn’t an extra payment.

Extra pay taxation options

MYOB Acumatica includes four taxation options specific to extra pays:

Taxable: Bonus / Commission (Common Pay Group / Pay Run) – use this option when the extra pay is a regular payment (e.g. a bonus or commission) and is in the same pay group and pay run as normal earnings.

Taxable: Bonus / Commission (Separate Pay Group / Pay Run) – use this option when the extra payment is a regular payment (e.g. a bonus or commission) but is in a different pay run than the normal earnings (either in a separate pay group or in a separate pay run in the same pay group).

Taxable: Extra Pay (Back Pay – Financial Year To Date) – use this option when the extra pay is a one-off payment that is directly related to a specific period e.g. back-payment of a pay rise.

Taxable: Extra Pay (Lump Sum – Full Year) – use this option for a one-off payment that is not directly related to a specific period e.g. a sign-on bonus for entering a workplace agreement.

When “Taxable: Bonus / commission (Common Pay Group / Pay Run)” is selected, the system only uses earnings from the Current Pay. If any of the other three options is selected, the system will look for income in the Current Pay and any other pay runs during the relevant period to determine the gross earnings, so that tax is calculated correctly.

The taxation option determines the duration that the system will look at to determine the average gross earnings and the duration (number of periods) that tax on the extra pay will be apportioned across:

Taxation option | Average gross earnings | No. of periods taxed over |

Taxable: Bonus / Commission (Common Pay Group / Pay Run) | Current pay1 | Full year |

Taxable: Bonus / Commission (Separate Pay Group / Pay Run) | Current pay period2 | Current pay period |

Taxable: Extra Pay (Back Pay – Financial Year To Date) | Current FY to date3 | Current FY to date3 |

Taxable: Extra Pay (Lump Sum – Full Year) | Full year/12 months | Full year/12 months |

1 The system will look for income in the pay run that the extra pay is in.

2 The system will look for income in all pays in the same period as the pay run that the extra pay is in.

3 This is the default, but a custom date range can be entered (see Editing and overriding values).

You can change a pay item’s taxation option at any time. If the item is currently included in any employee’s Standard Pay or Current Pay, these pays will be updated for this change automatically.

Paying extra pays

To pay an extra pay to an employee, add the relevant pay item to their Standard Pay (for regular payments) or Current Pay (for one-off payments).

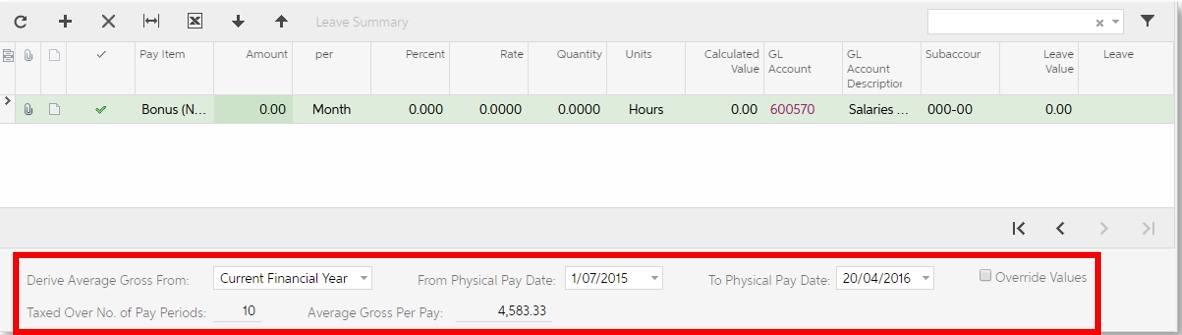

When the pay item is selected on the Employee’s Current Pay form (MP.PP.31.30), the calculated average gross per pay and the number of periods taxed over are displayed in the footer:

A warning message appears if the Average Gross Per Pay is $0—this could mean that the pay item has been set up incorrectly. You may need to edit the pay item to change its taxation option or manually override some values (see below).

The selection in the Derive Average Gross From dropdown determines the period that the system will use when calculating the average gross earnings, as specified by the pay item’s taxation option (see Extra pay taxation options). You can change the Derive Average Gross From selection, which updates the other values in the footer.

Editing and overriding values

For regular extra payments (e.g. bonuses or commissions), the standard configurations should allow a “set and forget” approach, i.e. the taxation options should not require changing in the Current Pay. In other cases, it may be necessary to edit or override the values in the Current Pay—you can do this in several ways:

You can override the Average Gross Per Pay and Taxed Over No. of Pay Periods values directly by checking the Override Values box and entering new values. This clears the From Physical Pay Date and To Physical Pay Date fields and makes them read-only, as they are not needed if you are entering values manually.

When the Current Financial Year option is selected from the Derive Average Gross From dropdown, the From Physical Pay Date and To Physical Pay Date fields can be edited. Whatever date range you enter will be used to find physical pay dates that fall within the date range; the tax calculation will normalise for the pay period length of the pay run that the extra pay appears in, e.g. if the extra pay is in a monthly pay run and the period being taxed over is a year, the number of pay periods will be 12; if the extra pay is in a six-monthly pay run, the number of pay periods will be 2. The Average Gross Per Pay will be updated accordingly.

When the From and To dates are overridden, the system will find pays that fall all or mostly within the selected date range. If less than half of a pay is within the date range, it will be excluded.

In the case where the extra pay is being paid in a separate pay run for the same pay group as normal earnings, the Average Gross Per Pay gross might calculate as $0, as it uses the pay period of the pay group (e.g. a weekly pay group used to make four weekly runs with salary, and one special run with commission).

If the average gross calculates to $0 in this case, you will need to do one of the following to correct it (in order of easiest to hardest):

Create a separate pay group to process the extra pay. This should be the most efficient way of solving the problem. (Remember that MYOB Acumatica allows an unlimited number of pay groups and employees can belong to as many pay groups as you want.)

Edit the date range for the pay run containing the extra pay, ensuring that the range you enter overlaps with another pay run that includes normal earnings.

Override the Taxed Over No. of Pay Periods value to a number that will catch all normal earnings since the last pay run that included the extra pay.

Override the Average Gross Per Pay value to a meaningful number.

Setup summary

The basic steps to follow when setting up and using an extra pay item is:

Configure the pay item, selecting the appropriate taxation option.

Add the pay item into employees’ Standard Pay or Current Pay.

In the Current Pay, review the automatically configured items and edit taxation details if appropriate:

Derive Average Gross From option

Number of periods taxed over

Average gross earnings per pay

If necessary, edit the pay item’s taxation option

If the payment is for a specific date, edit the From Physical Pay Date. (In this case, the Taxable: Extra Pay (Back Pay – Financial Year To Date) taxation option should be used, which means that the dates will be editable.)

If the Average Gross Per Pay calculates to $0, a warning will be displayed. It may be necessary to change the taxation option or the From Physical Pay Date and To Physical Pay Date, or tick the Override Values checkbox and enter an appropriate value.

Examples

The following examples describe the recommended configuration settings for several common extra pay scenarios.

Regular commission, paid monthly in the same pay group as normal earnings.

Select the Taxation option Taxable: Bonus / commission (Common Pay Group / Pay Run). This will use the current pay run as the average gross earnings value, but excluding the commission pay item. The tax on the commission will be calculated by spreading the commission across a full year of payments in this pay group.

Regular commission paid to a salesperson who is paid weekly, but the commission is paid monthly.

In this case, the commission will count as ordinary times earning (OTE), attracting super. Create a separate monthly pay group for the commissions, and set up a pay item using the Taxation option Taxable: Bonus / commission (Separate Pay Group / Pay Run). This will use the bonus pay group frequency of monthly, and find all salary pay runs in that month to calculate the average gross earnings and tax on the bonus.

Regular quarterly bonus paid to an employee who is paid monthly.

This can be achieved in one of two ways:

Create a new quarterly pay group. Set up a pay item using the Taxation option Taxable: Bonus / commission (Separate Pay Group / Pay Run) and add it to employees’ Standard Pays.

Set up a pay item using the Taxation option Taxable: Extra Pay (Back Pay – Financial Year To Date). To pay it, add this item to employees’ Current Pays and set the From and To dates to cover the quarter that the bonus is being paid over.

Pay rise, back-dated for the financial year-to-date.

Use the Taxation option Taxable: Extra Pay (Back Pay – Financial Year To Date) and insert the pay item into the employee’s Current Pay. The current financial year to date will be used as the default date range, so no extra configuration is needed.

Pay rise, back-dated to the employee’s anniversary date.

Use the Taxation option Taxable: Extra Pay (Back Pay – Financial Year To Date) and insert the pay item into the employee’s Current Pay. In the Current Pay footer, change the From Physical Pay Date to the employee’s anniversary date. This will calculate tax based on spreading the pay rise across the period, achieving the same taxation as if it had been included in their normal earnings from that date.

One-off bonus as a thank you for helping the company change payroll systems to MYOB Acumatica.

This is not OTE, so will not attract super. Use the Taxation option Taxable: Extra Pay (Lump Sum – Full Year) and insert the pay item into the employees’ Current Pays. As there is no specific date range to apply the bonus to, the system will use the last 12 months’ pays to determine the average gross earnings and calculate the tax.

Appendix 1: Method A

The Method A calculation for extra pays uses the Schedule 5 Tax Table, Method A as described on the ATO website.

Method A has two components:

Average gross earnings (the base)

Duration (number of pay periods) that the additional payment is being apportioned across to calculate the additional tax.

The formula for Method A can be summarised as follows:

Calculate the average gross earnings over the relevant period, including extra payments but not the payment being taxed now.

Apportion the extra payment over the relevant duration / number of pay periods.

Add the 2 together – this gives a notional, per pay period, combined earnings amount.

Calculate tax on the average gross earnings.

Calculate tax on the notional combined earnings.

Subtract 5 from 4 to give the per pay period additional tax.

Multiply the per pay additional tax by the number of pay periods that the payment was apportioned across (see step 2). This gives the total tax on the extra payment (which is capped at 47%).

The “pay period” refers to the current pay for the pay group i.e. the pay that contains the payment being taxed.