2022.2.2 Release notes

New features

MYOB Advanced Payroll

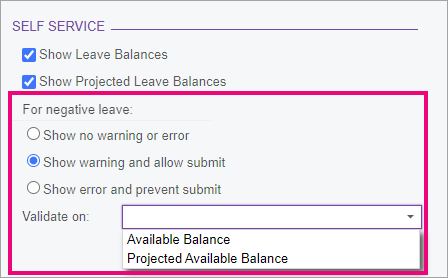

To reduce the number of unnecessary leave requests and empower employees to manage their leave themselves, we've added the ability to add a warning message to leave requests that would result in a negative leave balance, or even stop them from being made.

To set this up, we've added new options to the Entitlements form (MPPP3300), in the Self Service section of the Rules tab.

Select one of three For negative leave options:

- Show no warning or error – Employees aren't warned when they submit leave requests when that would take them into a negative leave balance.

- Show warning and allow submit – Employees are warned that their request will take them into negative leave, but they can still submit the request.

- Show error and prevent submit – Prevents employees from submitting leave requests that would take them into a negative leave balance.

If you choose to show a warning or error, you also need to select a Validate on option. This determines whether these settings are based on the employee's current leave balance, or a projected leave balance on the date of the leave application.

Recalculating projected leave balances

If you set an entitlement to show a projected leave balance in Employee Self Service, MYOB Advanced Payroll will automatically recalculate projected balances for new leave requests.

However, to be able to approve leave requests made before you upgraded to 2022.2.2, you need to manually recalculate projected leave balances on the Leave Administration form (MPPP5040). Select at least one Open, Submitted or Declined leave request, then click the new Recalculate Projected Balance option on the form toolbar.

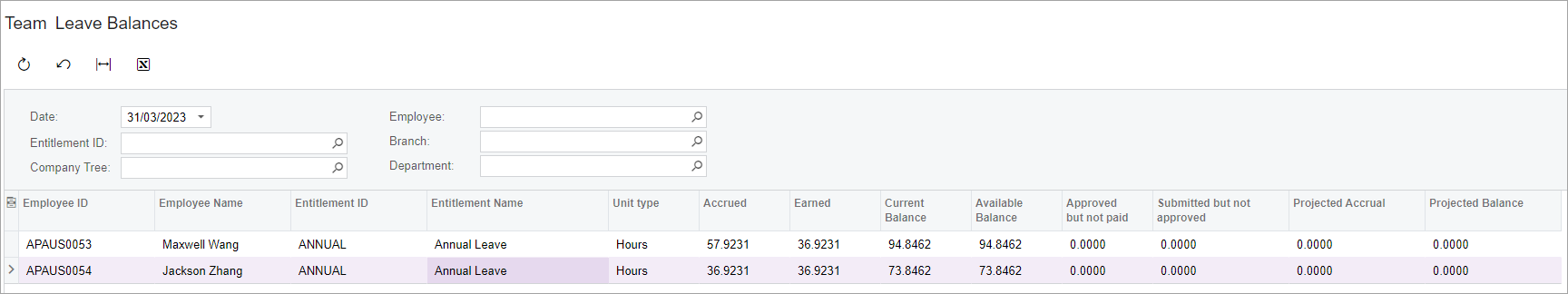

In MYOB Advanced Employee Self Service, managers can now easily review their employees' leave balances by using the new Team Leave Balances report (MPEM3023). This report is only available to users with the People MSS role selected on the Users form (SM201010).

To reduce the amount of time spent setting up new employees in MYOB Advanced Payroll when imported from MYOB Advanced Workforce Management, we've added employee profiles, that let you create template for different types of employees, with settings like their pay details, branch, and cost-centre pre-populated.

To get started, see Setting up employee profiles.

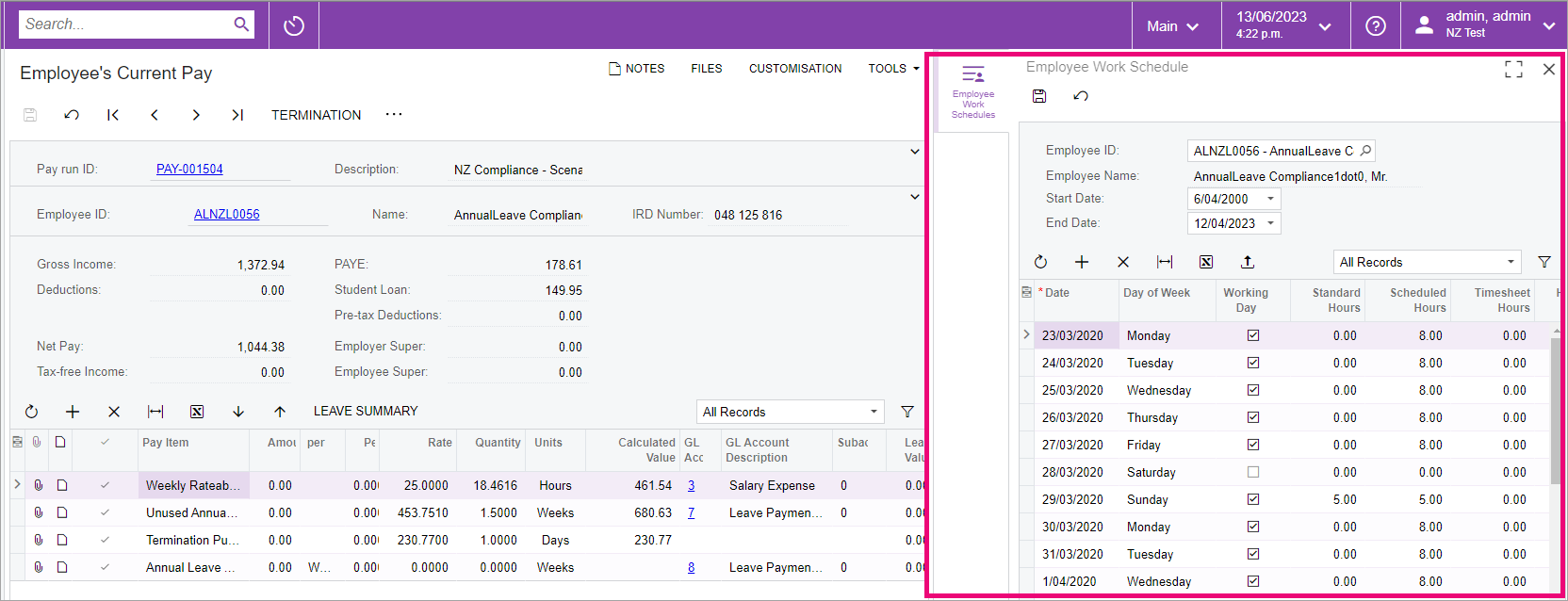

You can now view and edit an employee's work schedule in a side panel while working on their current pay.

On the Employee's Current Pay form (MPPP3130), click the Employee Work Schedules icon (![]() ) to open the side panel.

) to open the side panel.

We've improved the speed and responsiveness in some key areas, including:

- importing timesheets

- the Work Schedule form.

To help you keep tabs on changes to your payroll data, we've made some big improvements to auditing that extend the functionality without a loss of stability.

- You can now audit the Pay Details form. We've included some audit configurations that you can extend for your own needs.

- We've turned payroll auditing on permanently, and made it so you can choose which Pay Details fields are audited, so you can monitor the data that's important to you while reducing the performance impact caused by auditing fields unneccessarily.

Some auditing is required by legislation If you'd like to turn payroll auditing off, please contact your MYOB Advanced support person.

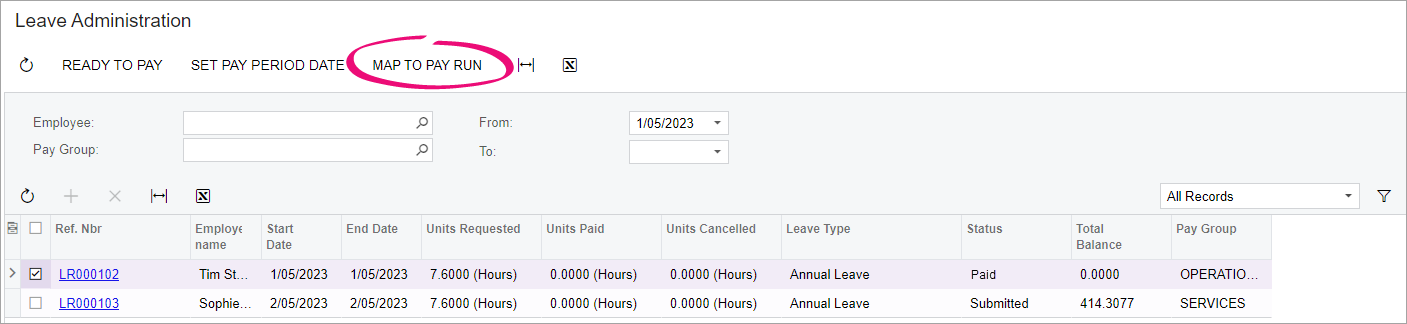

If an employee makes a leave request in the Employee Self Service (ESS) module after you've already manually entered their request into a pay run, you can now map the ESS request to the pay run. This makes sure that leave request statuses are correct in ESS and on the Leave Administration form (MPPP5040).

On the Leave Administration form, select a Paid or Partially Paid leave request and click Map to Pay Run on the form toolbar.

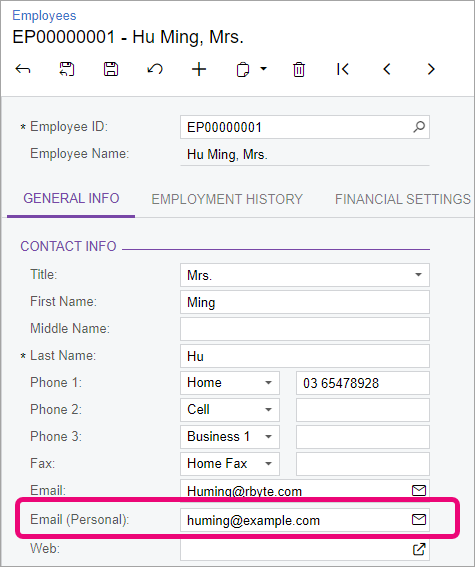

You can now add an employee's personal email address to their contact information. This lets you send their payslip to their personal email address.

To set this up, complete the new Email (Personal) field on the General tab of the Employees form (EP203000).

Then, on the Settings tab of the Pay Details form (MPPP2310), there are new checkboxes that let you select where to send their payslips and payment summaries: Use Personal Email (Portal link) and Use Personal Email.

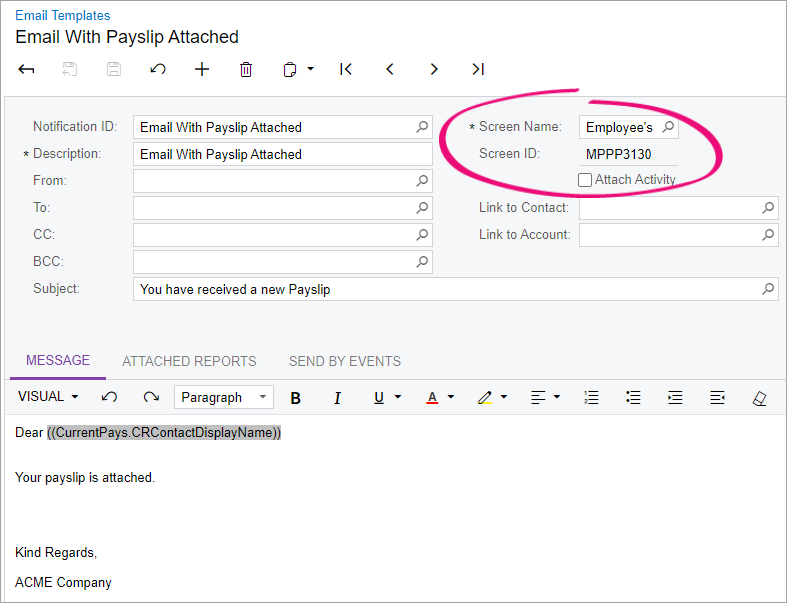

On the Email Templates form (SM204003), you now have more choice of what information to include in the default Email With Payslip Attached template. We made this improvement by the changing the screen name and screen ID to the Employee's Current Pay (MPPP3130).

To make sure you're getting the clearest, most accurate, and most useful entitlement information, we've retired the Entitlement Summary Report.

The Entitlement Detail Report is still available, but use the Leave Balances & Liabilities Report for the best information.

- For companies using MYOB Advanced Workforce Management, you no longer need a customisation to make sure employee data changes in Workforce Management flow across to Advanced Payroll.

- If your company generates payslips during payslip processing, the Process Payslips form (MPPP5215) now generates payslips more quickly.

- For entitlement payment pay items, we've removed the Override Value options from the Pay Items form (MPPP2210), as the options aren't relevant to that pay item type.

- We've made it so employees can see more details in the employee self-service mobile app, to help them make more informed leave requests. These include leave balances (available and projected) and a conversion into equivalient units in hours, days, or weeks.

- We've removed the Client Setup NZ form, which was used in the past to import pay history in New Zealand, and has been superceded. For more information, see Importing pay history - NZ only.

- To make it easier to reconcile your payroll expenses with the general journal batches, we've made it so the payroll expense allocation journal batch uses the physical pay date, rather than the period end date.

- Improved a range of error messages and warnings to help you resolve and avoid errors.

- You can now use the appropriate tax treatment codes for working holiday makers who have PAYG withholding variations (DVXXXX), or have died (DBXXXX).

Resolved issues

| Region | Description |

|---|---|

| NZ/AU | OData performance has been improved.

|

| NZ/AU | Two issues with setting up Secure Authentication have been resolved:

|

| NZ/AU | On the Details tab of the Journal Transactions form (GL301000), the main table had a section of blank white space. This has been resolved. The white space is now used to display more rows at once. |

| NZ/AU | Trace logs for errors sometimes didn't have any information in them. This has been resolved. |

| NZ/AU | When implementing Azure AD for a site, there were inconsistencies that could corrupt the implementation. This has been resolved. As part of this resolution, error messages are now more logical and easy to understand. |

| NZ/AU | PTRS values weren't always reflected appropriately in the correct company. This has been resolved. |

| NZ/AU | The in-product help for sites on a 2022.2 version only showed information from 2022.1 versions. This has been resolved. |

| NZ/AU | To avoid confusion, the Release Batch Payment Before Export checkbox on Payment Methods form (CA204000) is now selected by default. This restores the functionality to how it worked in versions 2022.1 and earlier: when creating bank files on the Batch Payments form, you need to release the transactions before exporting them. |

| NZ/AU | You couldn't add customisations to the Portal Preferences form (on the Customer Portal). This has been resolved. |

| Region | Description | Reference |

|---|---|---|

| NZ/AU | A rounding error was preventing journal entries from being posted. When completing a pay, debit and credit balances weren't equal, which prevented them from being posted. This has been resolved. | CE00031656 CE00031655 CE00034721 |

| NZ/AU | Previously, when creating an entitlement adjustment, you needed to provide a financial period even if you didn't post the adjustments to the general ledger. This has been resolved. | N/A |

| NZ/AU | There was an issue with accrual auto-adjustment portion to allocation of on cost expenses. This has been resolved. Now, when expenses related to entitlement accruals are allocated, they'll pick up the adjustment amount and allocate it using the same basis as the main portion of the entitlement accrual. | CE00034572 CE00034557 |

| NZ/AU | There was an issue when importing pay entries that did not get included in AWE and OWP calculations. When the hours worked were left blank in an import of pay entries the resulting calculated value was also blank. This has been resolved. | CE00035795 CE00035518 CE00035680 |

| NZ | KiwiSaver rates on the Pay Details form were changing and couldn't be saved. This has been resolved. | CE00034670 CE00034044 CE00035182 CE00025184 CE00035384 CE00025484 CE00035551 CE0005552 CE00035676 CE00035949 |

| AU | On the Payroll Expense Allocation form, the Workcover expense calculation wasn't including the superannuation amount. The equivalent journal entries were being calculated correctly. This has been resolved. | CE00034380 CE00033926 |

| NZ | When an automation schedule was run for the employee work schedule import, there was no record count of how many items were imported. This has been resolved. Now, there's a record count so you can see how many employee schedules were imported from MYOB Advanced Workforce Management. Warnings and errors are also now shown. | N/A |

| AU | When adding default payroll tax categories on the Pay Item Types form (MPPP2160), an error could occur: "'Default payroll Tax Category' cannot be found in the system." This error blocked you from setting a payroll tax as a preset for a pay item type. This has been resolved. | N/A |

| NZ | Changing the last day of employment in the termination wizard could cause the gross earnings figure for a current pay to be incorrect if there were public holidays in the termination. This has been resolved. | N/A |

| NZ/AU | Importing timesheets could cause total payroll values for employee and employer super to be incorrect. The values were correct on completing a pay run, but they'd be incorrect while the pay was open, making it difficult to get accurate reports on total super figures. This has been resolved. | N/A |

| AU | Creating an STP report could take longer than usual and it could time out. This has been resolved. | CE00036473 CE00036452 CE00036661 CE00036867 CE00036963 CE00037335 |

| NZ | An integration error could occur when onboarding employee exempt from the an ACC levy. This has been resolved. | N/A |

| AU | If a super fund (APRA) had the same name as another super fund, it wasn't possible to select a second fund that had the same name. This has been resolved. | N/A |

| NZ | After updating MYOB Advanced Payroll, if an employee had opted out of KiwiSaver, then KiwiSaver pay items were still added to their standard pays whenever you updated the employee in MYOB Advanced Workforce Management. This has been resolved. | CE00035876 CE00035875 |

| AU | For clients that had transitioned to STP Phase 2, a warning could occur: "The TFN Declaration has not been submitted." This has been resolved. This warning will no longer appear after migrating to STP Phase 2. | CE00035473 CE00034958 CE00035385 CE00035462 CE00036026 CE00038623 |

| NZ/AU | The employee numbering sequence could have branch-specific sequences. This has been resolved. The employee profiles feature now allows for multibranch configuration. | CE00024850 CE00024820 CE00024864 CE00024813 CE00027867 |

| NZ/AU | If you entered a salary for an employee in MYOB Advanced Workforce Management, there could be rounding issues on the salary value in MYOB Advanced Payroll. As a temporary measure before the salary value is added to the integration, you can now choose to automatically round the salary result to the nearest dollar. To do so, select the new Round salary values to the nearest dollar on employee onboardings and updates checkbox on the Workforce Management tab of the Payroll Preferences form. | N/A |

| NZ/AU | The Onboard an employee option appeared on Employees screen even if MYOB Advanced Payroll wasn't enabled. This has been resolved. | N/A |

| NZ/AU | If MYOB Advanced Workforce Management had sent a timesheet that incorrectly mapped employee IDs or pay item IDs, those records wouldn't appear in the MYOB Advanced Payroll timesheet batch. This has been resolved. The timesheet batch now shows these timesheets and warns you if the data is not mapped correctly. | CE00031487 CE00031485 |

| AU | After creating a pay item, the pay item liabilities wouldn't reflect if the pay item was liable for payroll tax. This has been resolved. | CE00015604 CE00015551 |

| AU | When exporting SAFF for super, the employee phone was missing. This has been resolved. | N/A |

| NZ/AU | If an employee has assigned accrual pay items, which are related to underlying entitlements that have trigger date rules of Calendar Year or Employee DoB, business rules have now been implemented. These rules result in correct accrual movements and anniversary rollovers. | N/A |

| AU | The employer superannuation maximum threshold was not being applied to a termination pay run. This has been resolved. | CE00037309 CE00037192 |

| NZ | The ESCT value was being used incorrectly to represent a value when it should have been zero (0). This occurred when the employer superannuation value was calculated using the PAYE method. This has been resolved. | |

| NZ/AU | Duplicate lines on the Entitlement Balance Details and Entitlement Balance Summary reports have been resolved.

The Entitlement Balance Summary report has been retired in New Zealand.

| N/A |