2020.5.4 Release Notes

Introduction

The 2020.5.4 release addresses the legislative changes that take effect in New Zealand from 1 April 2021, and updates MYOB Advanced People to produce files for payday filing in the new v2021 format.

This information is also available as a PDF document:

New Features

Tax Updates

NZ companies only

Updates to Tax Codes

From April 2021, new tax rates apply to the M and ME tax codes, and two new tax codes for secondary income become available. The tax code changes are as follows:

- M, ME, M SL and ME SL – Annual income greater than $180,000 is now taxed at a rate of 39%

- SA – New tax code for secondary income greater than $180,000

- SA SL – New tax code for secondary income greater than $180,000 with student loan

The new SA and SA SL tax codes have been added to the Tax Code dropdown on the Taxation tab of the Pay Details screen (MPPP2310).

The new tax codes apply from 1 April 2021—while you can apply them to an employee before this date, you will not be able to save that employee’s Standard Pay, unless you update the MYOB Advanced business date to 1 April 2021 or later. Similarly, if a pay run dated prior to 1 April 2021 contains employees with the new tax codes, this will cause an error unless the MYOB Advanced business date is updated.

Student Loan Thresholds

This release updates the student loan thresholds for the 2021–2022 financial year. The new thresholds are:

- Annual - $20,280

- Monthly - $1,690

- 4-weekly - $1,560

- Fortnightly - $780

- Weekly - $390

ACC Rates and Thresholds

The ACC Earner Levy rates and threshold have not been changed for the 2021–2022 financial year; however, the earner levy calculated on secondary earnings is now capped at the existing annual threshold of $130,911, where previously the earner levy was paid on every dollar of secondary income.

ESCT Thresholds

This release updates the ESCT thresholds for the 2021–2022 financial year, adding a new top rate of 39%. The thresholds are now:

| Threshold amount | Tax rate |

|---|---|

| $1 - $16,800 | 10.5% |

| $16,801 - $57,600 | 17.5% |

| $57,601 - $84,000 | 30% |

| $84,001 - $216,000 | 33% |

| $216,001 upwards | 39% |

The new 39% rate is available from the ESCT Rate dropdown on the Taxation tab of the Pay Details screen (MPPP2310).

Important: Updating Employee Records

The new SA and SA SL tax codes and the new 39% ESCT rate apply from 1 April 2021—while you can select them on the Pay Details screen for an employee before this date, you will not be able to save that employee’s Standard Pay, unless you update the MYOB Advanced business date to 1 April 2021 or later.

Similarly, if a pay run with a Physical Pay Date prior to 1 April 2021 contains employees with the new codes and/or rate, this will cause an error unless the MYOB Advanced business date is updated.

Payday Filing Updates

NZ companies only

This release updates MYOB Advanced People to produce files for payday filing in the new v2021 format. This includes the EI Return file and the Employee Details (ED) file.

The Employee Details file now includes KiwiSaver information for employees. Because KiwiSaver information is now included in the ED file, you no longer need to produce and send the KiwiSaver Employment Details (KED) file. You can still produce a KED file from MYOB Advanced and send it to the IRD for now, but the KED file will not be accepted from 1 April 2021.

Because the screens that display the EI and ED files have been changed, you should make that there are no unexported EI batches in the system before the upgrade to 2020.5.3, as after the upgrade you will not be able to make further changes to them.

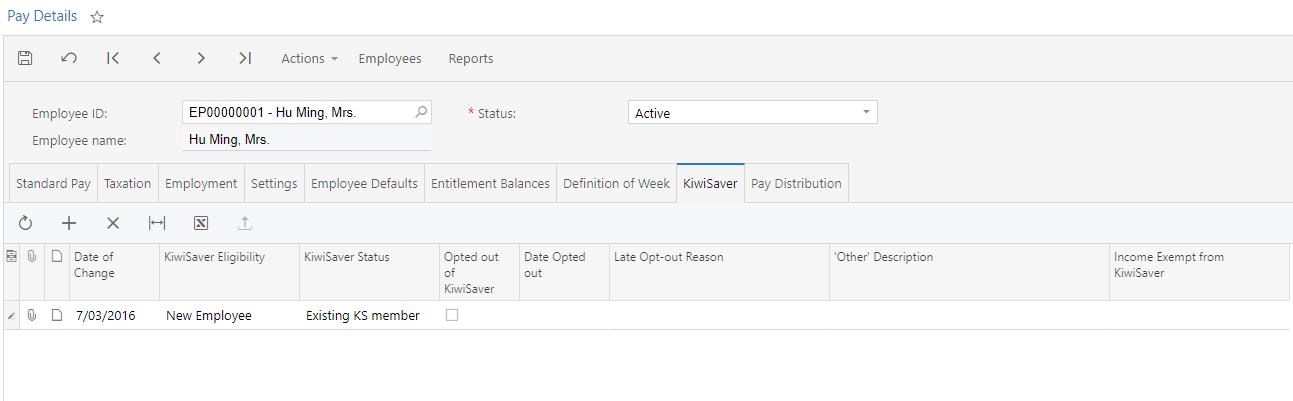

A new KiwiSaver tab has been added to the Pay Details screen (MPPP2310) to capture the additional KiwiSaver information:

Any time an employee’s KiwiSaver details change, add a new line to the table on this screen, so that the change is included in the next ED file. You do not need to add lines for your existing employees immediately after upgrading to this release—only as and when their KiwiSaver details change.

See the “Payday Filing” white paper on the MYOB Advanced Education Centre for details of all scenarios that require a change to an employee’s KiwiSaver tab.

Employee KiwiSaver Status

The KiwiSaver Eligibility column on the KiwiSaver tab records employees’ current eligibility for KiwiSaver. Choose from:

- New Employee - the employee is new to the company.

- Existing employee opt in - an existing employee has chosen to opt in to KiwiSaver, e.g.

- an employee turning 18 after their employment start date

- an employee who was 65 or older as at their employment start date

- an employee who started before 2 July 2007 and had not previously joined KiwiSaver

- Existing employee auto enrol - only to be used for casual employees that have been employed for more than 28 days.

The KiwiSaver Status column displays a new employee’s current KiwiSaver status. This column is only editable if KiwiSaver Eligibility is set to “New Employee”. Choose from:

- AE auto enrol

- AK existing KS member

- OK opting in

- NK not eligible

- CT casual/temp

See the “Payday Filing” white paper on the MYOB Advanced Education Centre for details of which settings you should select when adding a line.

KiwiSaver Opt Out Codes

The KiwiSaver information included in payday filing has been expanded to include information on employees who opt out of KiwiSaver after the normal opt out period. Employees can opt out of KiwiSaver between the ends of the second and eighth weeks of their employment (i.e. between days 14 and 56) - see “Opting out of KiwiSaver” on the IRD website for more information.

To opt out after the end of this period, a reason for the late opt out must be accepted by the IRD Commissioner before the opt out is effected.

On the employee’s KiwiSaver tab, add a new line for the opt out, tick the box in the Opted out of KiwiSaver column, enter the Date Opted out, then choose from one of the following reasons from the dropdown in the Late opt out reason column:

- Employer didn’t provide a KiwiSaver information pack within seven days of starting employment

- Inland Revenue didn’t send an investment statement upon allocation to a default scheme

- Employer didn’t send an investment statement for the employer’s chosen scheme

- Events outside of control meant that the opt-out application was unable to be submitted within the eight week time limit.

- Employee did not meet the criteria to join KiwiSaver

- Employee was incorrectly enrolled under the age of 18

- Other explanation

KiwiSaver Exempt Income

If a new employee’s pay includes any income that is exempt from KiwiSaver, select an option for the Income Exempt from KiwiSaver column. This column is only editable if KiwiSaver Eligibility is set to “New Employee”. If more than one reason applies, select the reason that accounts for the greater part of the employee’s pay. Choose from:

- Board-lodging

- Taxable allowances for accommodation

- Voluntary Bonding Scheme

- Retiring allowance

- Overpayment of employer’s super cash contribution

- Honoraria payments

IRD Update Date

If an IRD number and tax code are entered for an employee who previously had no IRD number and a tax code of “ND”, this must now be reported in the Employee Details file.

If an employee’s taxation details change in this way, the date when the new IRD number and tax code were entered is recoded the new IRD Update Date field on the Taxation tab of the Pay Details window (MPPP2310).

Interface Updates

The Employment Info Return (MPPP5024) and Employee Details Return (MPPP5025) screens have been updated to show the new information that is now included in payday filing returns.

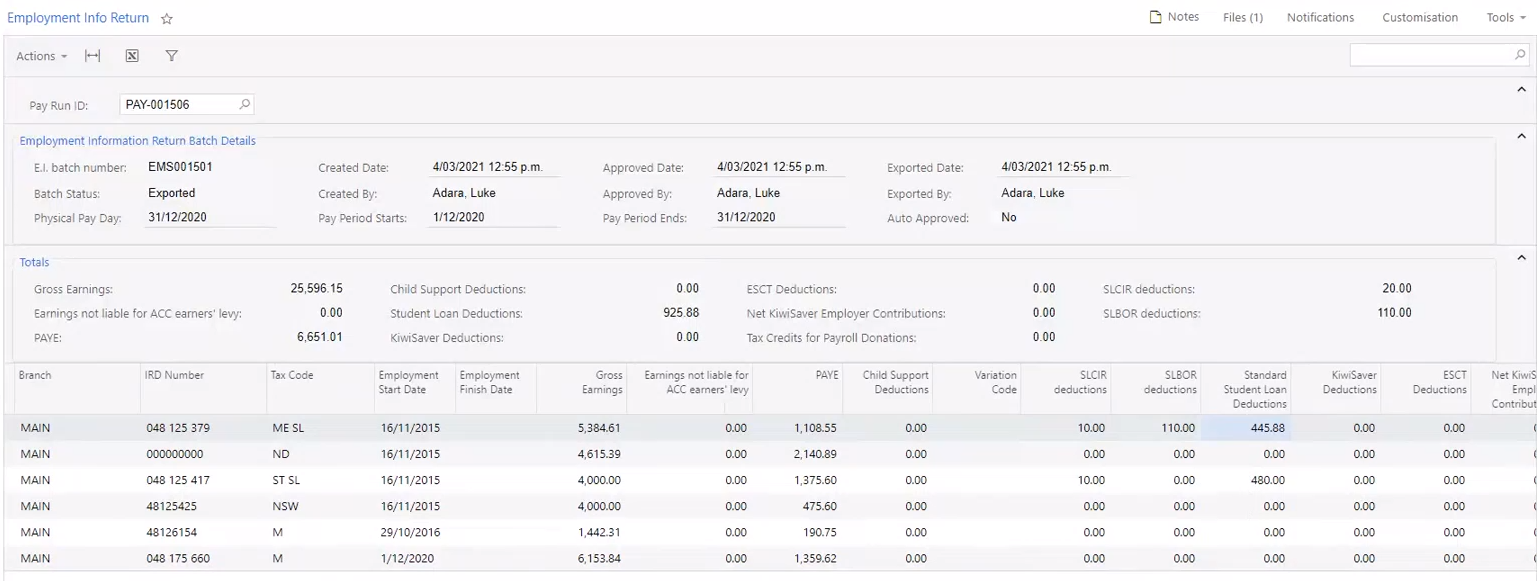

The Employment Info Return screen now shows separate SLCIR and SLBOR amounts in the Totals section and in the main table:

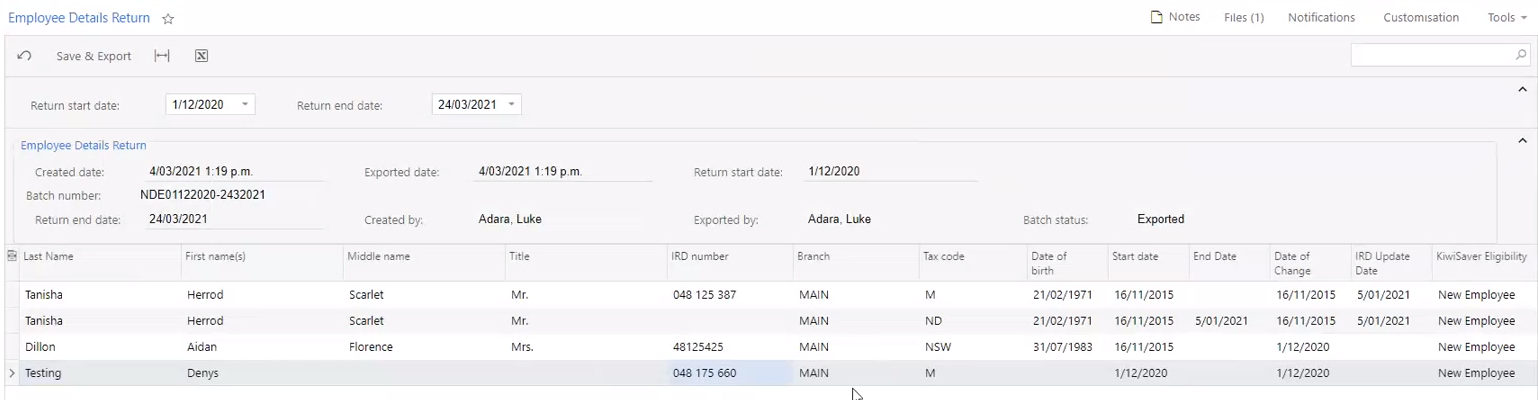

The Employee Details Return now shows KiwiSaver information in the main table, including columns for KiwiSaver Eligibility, KiwiSaver Status, and KiwiSaver opt-out details:

Update to Pay Item Configuration

The controls over allowing pay item parameters to be overridden in employees’ Standard and/or Current Pays were incorrect, allowing overrides that were in breach of the pay item functional design. The controls have been reinstated in 2020.5.4.

If a pay item’s Calculation Method is “Rated”, and set to one of the configured rates, then the rate value in employee’s standard and current pays will always be sourced from the relevant Employee Pay Group. The exception is if the employee is not a member of the pay run’s pay group (i.e. has been manually added to the pay run) and therefore there is no employee value for the configured rate.

If a pay item rate needs to be overridden at either the Standard or Current Pay level, then it should be configured to use a custom rate.

Pay items that are linked to an entitlement always use the valuation configured by the entitlement (i.e. entitlement accrual or entitlement payment pay item types). Units are driven by the accrual method, or the Days Taken window in the Current Pay (if the entitlement is configured with the Leave property ticked).

If a pay item’s Calculation Method is set “Amount” and “per Year”, then the amount value in employees’ Standard and Current Pays will always be sourced from the Annual Salary field on the Employee Pay Groups screen (MPPP2250), as long as there is a value set there. Otherwise the amount can be set at the pay item, Standard Pay or Current Pay level.

The Override Value controls for Standard and Current Pays will allow overrides if ticked, and prevent overrides if not ticked. The override functionality covers custom rates, amounts (except salary as above), percentage values, and units/quantity (except entitlements as above).

Resolved Issues