Refunding Kiwisaver contributions to an employee after opting out (New Zealand)

KiwiSaver is part of a government initiative that began in 2007 and is designed to increase the level of savings by New Zealand households and to support New Zealanders in their retirement.

New employees in a company are automatically enrolled in Kiwisaver and can choose to opt-out between the second and eighth weeks.

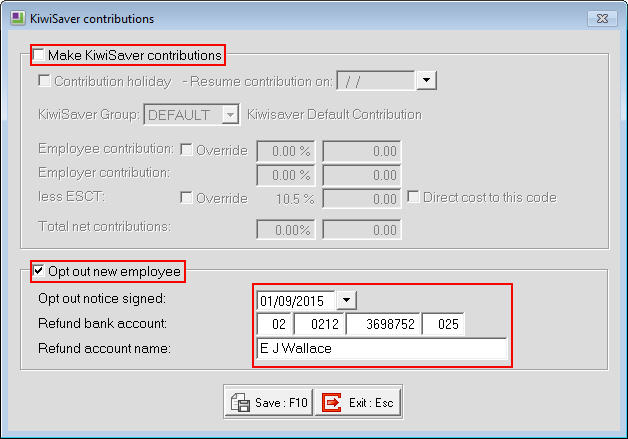

After an Employee has opted out of Kiwisaver, Inland Revenue will notify their employer. This will require the Employer to stop making any deductions of Kiwisaver from the Employee's Pay as well as making Employer Contributions.

Inland Revenue will refund the Employee any contributions that have already been deducted from the Employee's Pay & any contributions made from the Employer. However, if they Employer hasn't yet paid this to the IRD then the Employer can refund this to the Employee.

https://www.ird.govt.nz/kiwisaver/kiwisaver-individuals/opting-out-of-kiwisaver

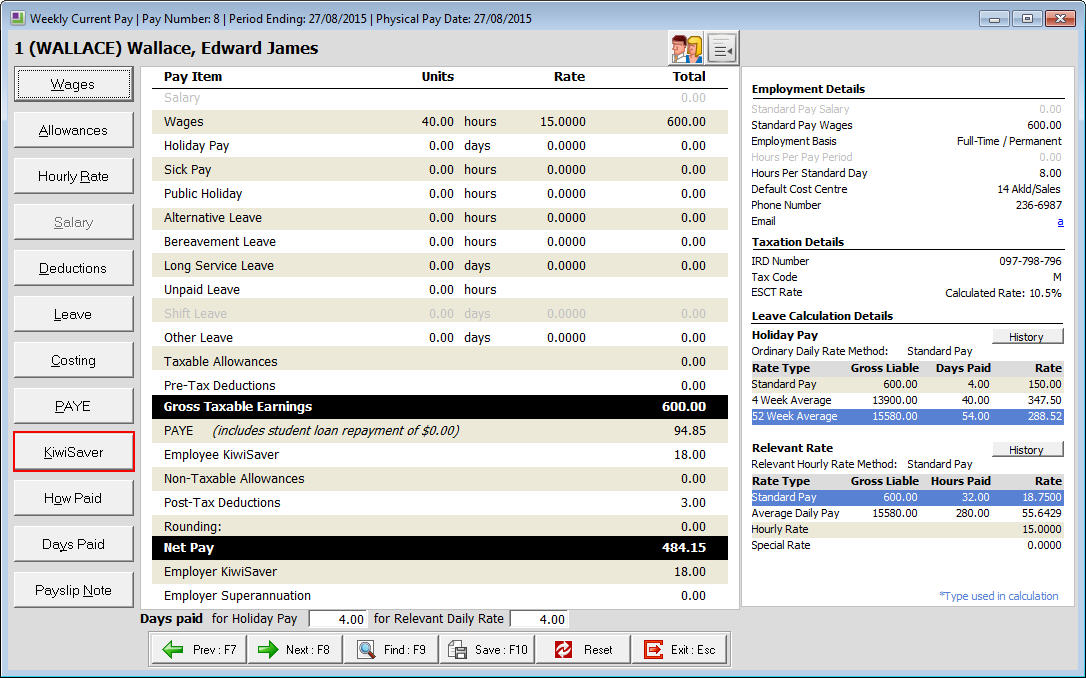

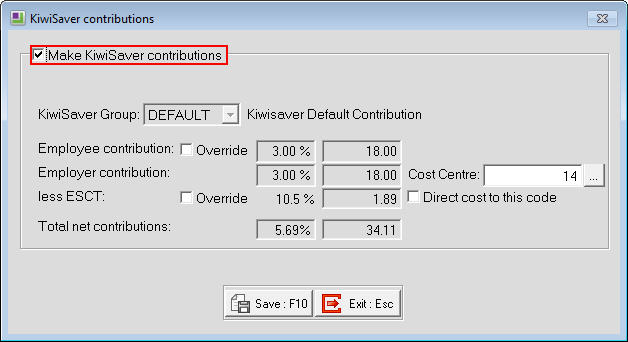

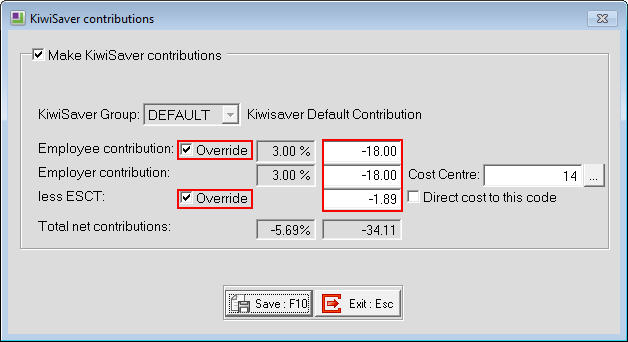

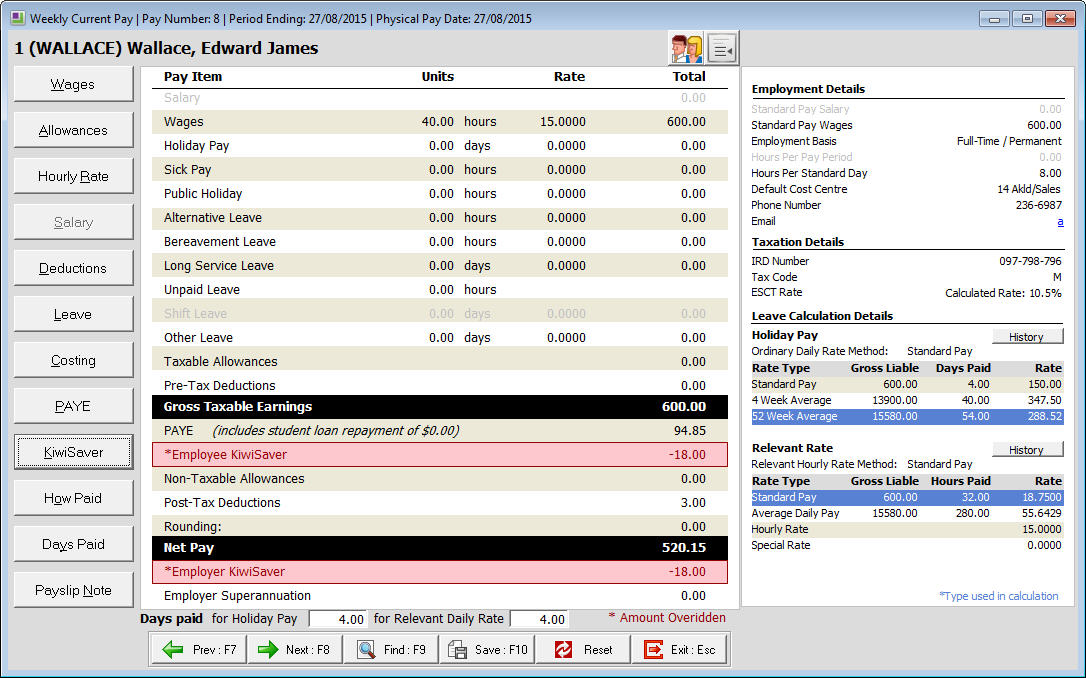

If any of the Kiwisaver Contributions have not been paid to the IRD, these figures can be refunded in a Current Pay in Exo Payroll.

Need more help? You can open the online help by pressing F1 on your keyboard while in your software.

You can also find more help resources on the MYOB Exo Employer Services Education Centre for Australia or New Zealand.