Doing a year to date loading including Kiwisaver contributions for the employee's financial year (New Zealand)

In this article we look at Year to Date Loading with Kiwisaver due to a change in Payroll systems or companies

The Load Year To Date Totals process in the EXO Payroll software for the Pay and Taxation History deals with Gross, PAYE and Student Loan figures for the current financial year. If you wish to include the Year To Date figures for Kiwisaver contributions, the Year To Date Loading process cannot be used and a One Off pay must be done for the figures.

Loading a year to date figure with Kiwisaver

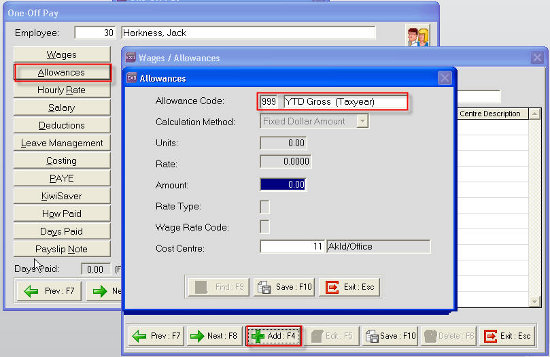

- Using a One Off Pay allows the entering of Year To Date figures for the employee's Kiwisaver contributions.

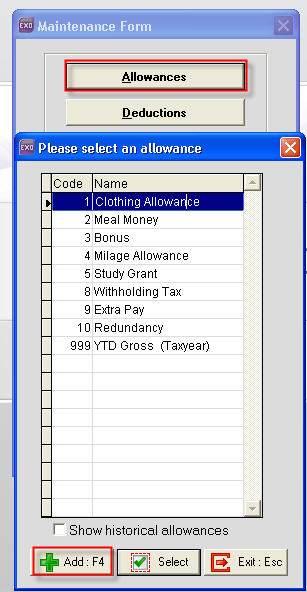

- The Gross Earnings must be paid in the One Off Pay through an allowance so that those earnings do not have an adverse effect on the Year To Date Loading for Annual Leave Calculations.

- The allowance should be given a high code number, such as 999, to ensure it is not accidentally used in normal pays.

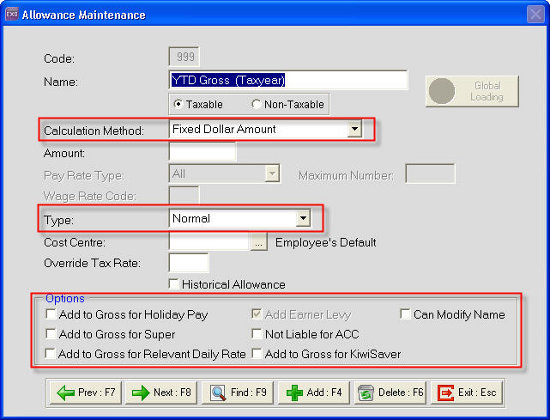

- The Calculation Method should be set to Fixed Dollar Amount

- Type set to Normal.

- Under the Options box untick all but the Add Earner Levy

- Save or press F10 then Exit or press Esc

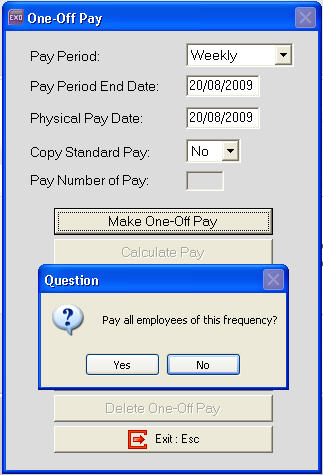

- Use the Pay Period date of the last pay processed for the employee in the old payroll software (or previous payroll company).

- If Year To Date loading is during the current month then the Pay Date being entered should be from the previous month. This is so that the Year To Date loading figures do not affect the IRD returns for the current month.

Need more help? You can open the online help by pressing F1 on your keyboard while in your software.

You can also find more help resources on the MYOB Exo Employer Services Education Centre for Australia or New Zealand.