Changing general ledger codes (Australia)

Sometimes you may need to change General Ledger codes as the business expands. To do this you may also need to make changes to or add new items in the Payroll.

Be aware that changing General Ledger codes will affect historical data.

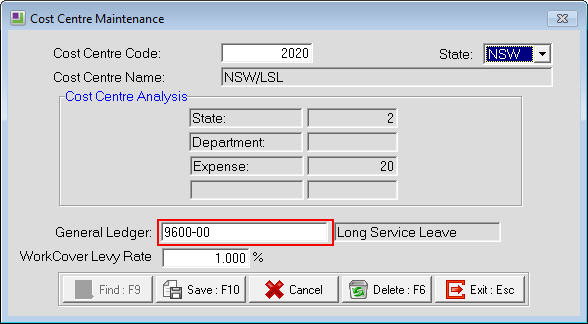

When a business expands the General Ledger codes currently being used may need to be changed to cater for the expanding business. General Ledger codes are assigned to most items in Exo Payroll including allowances, cost centres, deductions, etc. When General Ledger codes are changed then those codes assigned to the items in Exo Payroll must be updated to the new codes.

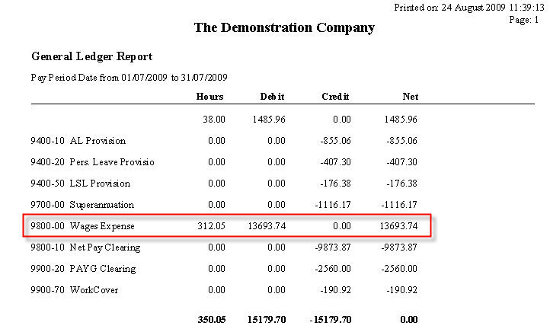

Below is an example of what changes would be made to a cost centre for a new General Ledger code and the impact on a General Ledger report of these changes.

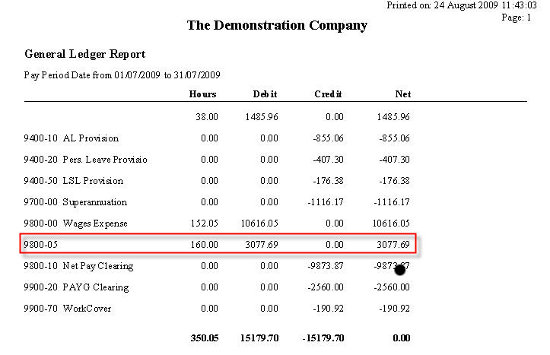

Here's how the General Ledger report looks before you make any changes:

Need more help? You can open the online help by pressing F1 on your keyboard while in your software.

You can also find more help resources on the MYOB Exo Employer Services Education Centre for Australia or New Zealand.