STP - Finalisation

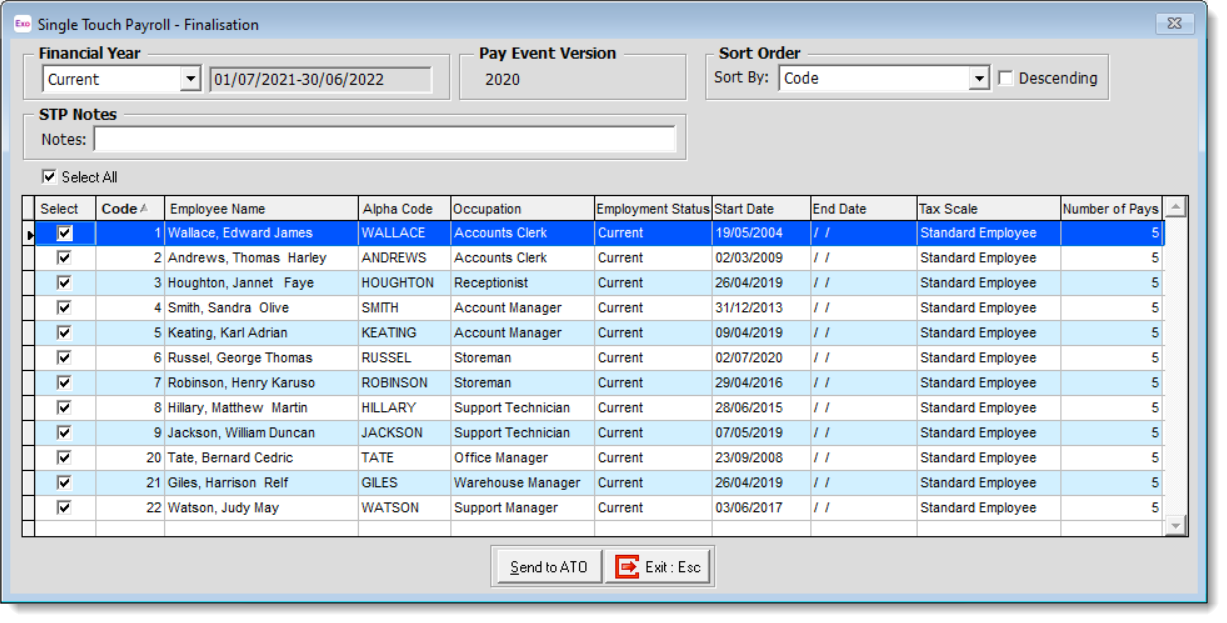

At the end of each financial year, you must send a finalisation declaration for each employee. This supplies year-end totals of the STP data for each employee, and indicates that you have provided all of their information for the financial year through STP reporting. To send a finalisation declaration for some or all employees, select Single Touch Payroll > Finalisation from the Pay menu. This opens the Single Touch Payroll - Finalisation window:

This window lists all employees with pays in the selected financial year, including employees who were terminated during the year. Use the check boxes to select the employees who you want to send finalisation declarations for (or click Select All), optionally enter a note into the STP Notes field, then click Send to ATO.

You can create new finalisation declarations for the “Current” and “Previous” financial years only - for the years “Current minus 2” to “Current minus 5”, you can only update existing declarations. This means that if one of these earlier years does not already have a finalisation declaration, you cannot select it.

As with STP submissions for individual pay runs, you can also update finalisation declarations for one or more employees if you need to correct the data - just open the Single Touch Payroll - Finalisation window again after correcting the data and use it to send finalisation declarations for the affected employee(s). A finalisation with a higher STP Number (as seen on the Single Touch Payroll Submissions window) will supersede earlier finalisations for the same period, provided that you have selected your employees carefully.