2025.01 release notes - AU

The 2025.01 release updates MYOB Exo Employer Services to comply with government requirements for the 2025–2026 financial year. You don't need to wait until the new financial year to install this release, as the compliance changes won't be activated in the product until 1 July 2025.

For detailed instructions on preparing for the end of the 2024–2025 financial year, see the end of financial year processes page.

Installing this release

Pre-install requirements

Requirements for PCs running Exo Employer Services components are detailed on the Minimum System Requirements page.

Installing Exo Employer Services

Check the release

To make sure this release installed successfully, check that the versions displayed on the About window (Help menu > About) match the versions listed here:

MYOB Exo Employer Services – 2025.01

MYOB Exo Payroll – 2025.01

MYOB Exo Employee Information – 2025.01

MYOB Exo Time and Attendance – 2025.01

Runtime Files – 09.00.0000.7423

Tax and compliance changes

PAYG

There are no changes to PAYG for Australian residents or non-residents.

Australian residents

The following table explains how much tax is paid on different incomes. The table doesn’t include the Medicare levy or any low income or middle income offsets.

Taxable income | Tax on this income |

|---|---|

0 to $18,200 | Nil |

$18,201 to $45,000 | 16 cents for each $1 |

$45,000 to $135,000 | $4,288 plus 30 cents for each $1 |

$135,000 to $190,000 | $31,288 plus 37 cents for each $1 |

over $190,000 | $51,638 plus 45 cents for each $1 |

Non-residents

The following table explains how much tax is paid on different incomes. Non-residents don’t pay the Medicare levy.

Taxable income | Tax on this income |

|---|---|

$0 to $135,000 | 30 cents for each $1 |

$135,001 to $190,000 | $40,500 plus 37 cents for each $1 |

$190,001 and over | $60,850 plus 45 cents for each $1 |

Student loans

The minimum repayment threshold has changed to $56,156 for the 2025–2026 financial year.

Medicare levy surcharge thresholds

From July 1 2025, Medicare levy surcharge thresholds are increasing. For details of the changes, see the ATO Medicare levy surcharge income, thresholds and rates page.

ETP changes

Employment Termination Payment (ETP) threshold amounts have changed as follows for the 2025–2026 financial year:

Amount | Old value | New value |

|---|---|---|

ETP cap | $245,000 | $260,000 |

Base limit | $12,524 | $13,100 |

Completed years service | $6,264 | $6,552 |

New companies created in the 2025–2026 financial year will be given these values by default. For existing companies, you must manually edit the values in the Payment setup > Termination Payments section of the Setup Payroll screen.

Superannuation

From 1 July 2025, the compulsory Superannuation Guarantee rate increases from 11.5% to 12%. When creating a new superannuation with the SG contribution type, the default percentage is 12 if the system date is 1 July 2025 or later; otherwise it is 11.5.

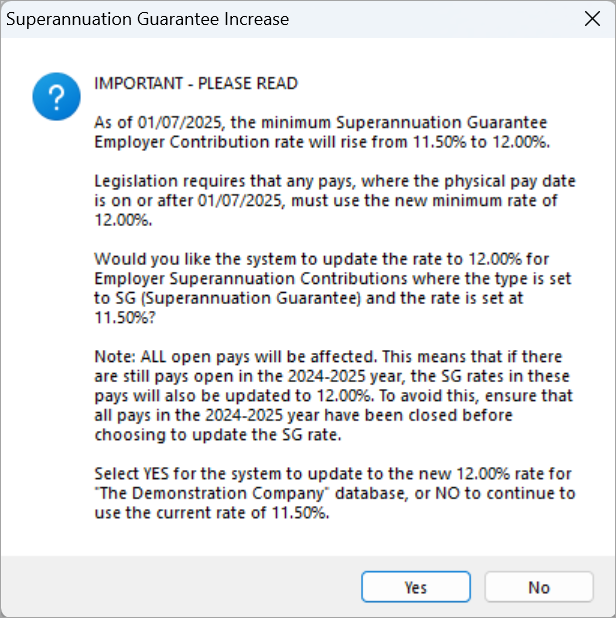

When creating a pay from 1 July 2025, a warning message appears:

To update all open pays, click Yes. If you click No, SG rates will stay as they are, and the warning will appear the next time you create a pay in the 2025–2026 financial year.

For employers who enforce the maximum earnings base for super guarantee contributions, the maximum super base quarterly amount has decreased to $62,500 for the 2025–2026 financial year. Update the Maximum Earnings Base field to this amount on the Superannuation Maintenance screen for all superannuations where the Contribution Type is SG. Any new superannuation created in the 2025–2026 financial year will have its Maximum Earnings Base set to the new amount by default.

Child support deductions

From 1 January 2025, the Child Support Protected Earnings Amount (PEA) changed as follows:

Frequency | Amount |

|---|---|

Weekly | $534.23 |

Fortnightly | $1,068.46 |

Four weekly | $2,136.92 |

Monthly | $2,322.95 |

Any new Child Support Deductions created after the installation of this release will contain these values as defaults. However, MYOB Exo Payroll does not automatically update these amounts in existing deductions. You must edit them on the Deductions Maintenance window for each Child Support Deduction (if you have not done so already):

The PEA amounts must be updated as shown for the first pay after 1 January 2024.

State payroll tax – Victoria

From 1 July 2025, the payroll tax free threshold has changed. For full details, see the State Revenue Office Victoria website.

MYOB Exo Employer Services only supports the changes that affect employers with wages below $3 million. For wages above that, we recommend using the payroll tax threshold calculator.

State payroll tax – Australian Capital Territory

We’ve added functionality for ACT State Payroll Tax changes that came into effect from 1 July 2024. For full details, see the ACT Revenue Office website.

Resolved issues

Description | Issue ID | Region |

|---|---|---|

If a company was set up with new leave management and the GL was set up to track provisions, then the GL account was not being assigned by default when an employee did not have a leave entitlement record on a pay date. | N/A | AU |

When multiple users are generating PDFs at the same time, we’ve added a warning to prevent issues with overwriting. | N/A | AU & NZ |

For MYOB Partners – STP certificate information

Installing this release also adds a new Single Touch Payroll (STP) security certificate. This certificate is valid until 13 May 2027.