End of tax year 2024 - NZ

This page explains the compliance changes related to MYOB Acumatica — Payroll for the 2024-25 tax year, along with procedures for supervisors or payroll administrators to prepare for the new tax year in MYOB Acumatica — Payroll.

If you'd like help with your end of tax year procedures, contact your MYOB Acumatica — Payroll consultant or email csenterprise@myob.com to book one of ours.

Compliance changes for the 2024-25 tax year

Below is the list of Inland Revenue (IR) changes for the New Zealand tax year 2024-2025, effective from 1st April 2024. There have been no changes to Kiwisaver or payday filing.

For full details, see Tax rates for individuals on the IR website.

To keep you compliant, when you open a pay with a physical pay date of 31 July 2024 or later, MYOB Acumatica — Payroll automatically applies these new tax rates and thresholds.

End of tax year procedures for 2024

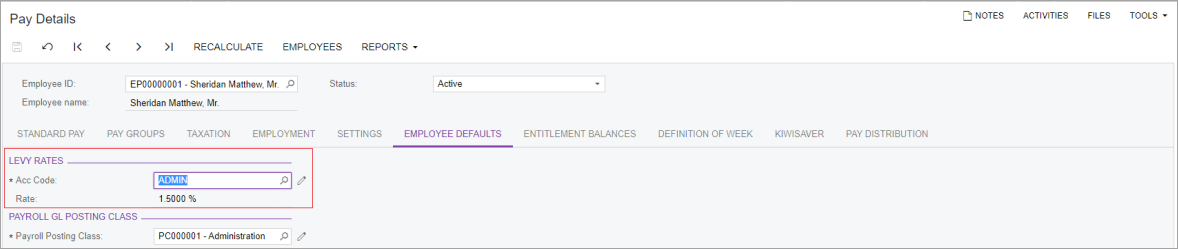

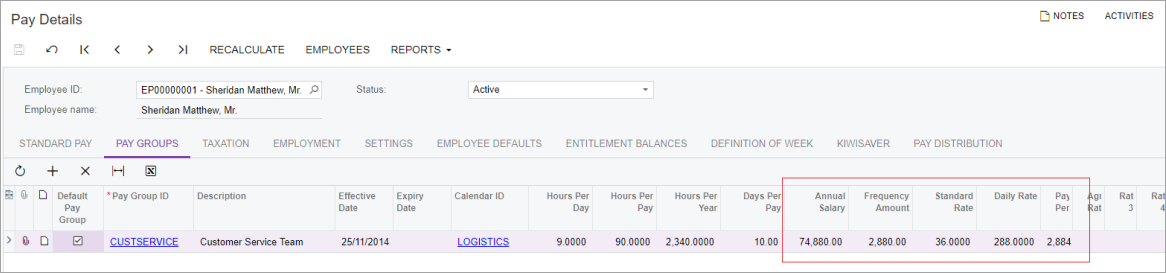

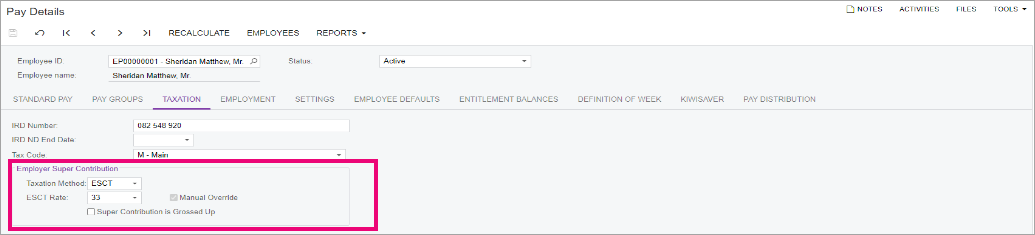

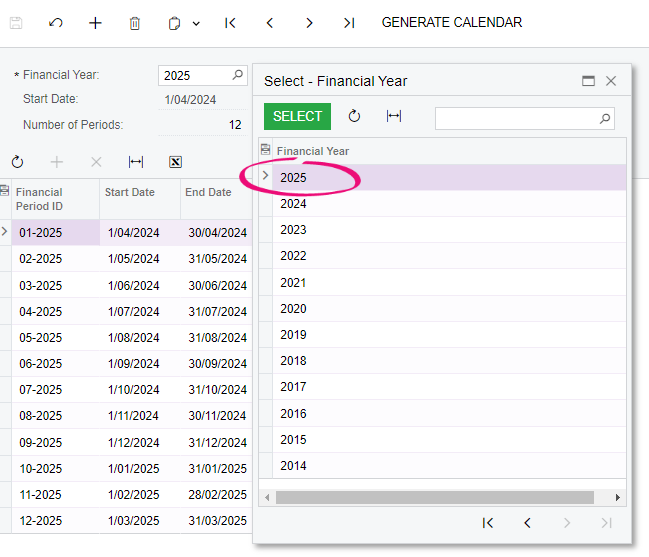

MYOB Acumatica — Payroll automatically updates some rates and thresholds to keep you compliant. However, you need to manually update minimum wage rates, the work calendar and ESCT rates. These manual updates are part of the end of tax year procedures in MYOB Acumatica — Payroll, which are all explained below.

To get started with these procedures, make sure you complete and close all pays for the tax year being updated.

You must complete these procedures before closing your first pay with a payment date in the new tax year.