End of financial year 2024 - Australia

This page explains the compliance changes for the 2024-25 financial year, and how to prepare for them in MYOB Acumatica — Payroll.

For supervisors or payroll administrators who run end of financial year procedures, you'll also find how to finalise up the 2023-24 year.

Some of the ATO articles that this page links to might not reflect the new compliance changes. These ATO articles will likely be up-to-date by mid-June.

Compliance changes for 2024-25

The following changes come into effect on 1 July 2024. In most cases, the new rates and thresholds are applied automatically when you open a pay with a physical pay date of 1 July 2024 or later.

For more details, see Tax tables on the ATO website.

PAYG

For Australian residents

Tax rates have changed.

On income between $18,201 and $45,000, the rate has reduced from 19% to 16%.

On income between $45,001 and $135,000, the rate has reduced from 32.5% to 30%

A 45% rate now only applies to income over $190,000. Previously, it applied to income over $180,000.

The following table explains how much tax is paid on different incomes. The table doesn’t include the Medicare levy or any low income or middle income offsets.

Taxable income | Tax on this income |

|---|---|

0 to $18,200 | Nil |

$18,201 to $45,000 | 16 cents for each $1 |

$45,001 to $135,000 | $4,288 plus 30 cents for each $1 |

$135,001 to $190,000 | $31,288 plus 37 cents for each $1 |

over $190,000 | $51,638 plus 45 cents for each $1 |

Non-resident PAYG tax rates and thresholds

The following table explains how much tax is paid on different incomes. Non-residents don’t pay the Medicare levy.

Taxable income | Tax on this income |

|---|---|

$0 to $135,000 | 30 cents for each $1 |

$135,001 to $190,000 | $40,500 plus 37 cents for each $1 |

$190,001 and over | $60,850 plus 45 cents for each $1 |

Shearing and horticultural industries

For foreign residents who provide a TFN, the tax rate has reduced from 32.5% to 30%. For more details, see the tax table for individuals employed in the shearing and horticultural industry on the ATO website.

Medicare levy exemptions for seniors and pensioner

Tax tables for seniors and pensioners now include full and half Medicare levy exemptions for the three payee categories: single, illness separated and couple. For more information, see tax tables for seniors and pensioners on the ATO website.

We’re adding support for this change in the upcoming 2023.1.5 release of MYOB Acumatica — Payroll.

Working holiday makers (WHMs)

If you're registered as an employer of WHMs, the following table explains tax rates for WHMs.

If you’re not registered as an employer of WHMs, you need to apply foreign resident withholding rates.

Taxable income | Tax on this income |

|---|---|

$0 to $45,000 | 15 cents for each $1 |

$45,001 to $135,000 | 30 cents for each $1 |

$135,001 to $190,000 | 37 cents for each $1 |

$190,001 and over | 45 cents for each $1 |

If WHMs don’t provide a tax file number, you must withhold at 45% on total payments made.

Return-to-work payments

For any employee who receives a payment to resume working or provide services, the withholding rate has reduced from 34.5% to 32%.

We’re adding support for this change in the upcoming 2023.1.5 release of MYOB Acumatica — Payroll.

Medicare levy surcharge thresholds

From July 1 2024, Medicare levy surcharge thresholds are increasing. For details of the changes, see the ATO Medicare levy surcharge income, thresholds and rates page.

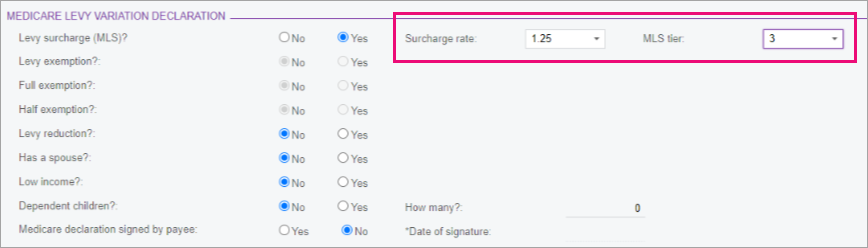

If any of your employees' Medicare levy surcharge changes as a result of the new thresholds, update their pay details:

Go to the Pay Details form (MPP3120).

Select the employee, and open the Taxation tab.

In the Medicare Levy Variation Declaration section, select the new Surcharge rate and MLS tier. If the employee is no longer required to pay a surcharge, select No for Levy surcharge (MLS)?

Save the record.

Student loans

There are no changes to the minimum student loan rates, but repayment thresholds are increasing, with the minimum repayment threshold changing from $51,532 to $54,435.

For full details of the new thresholds, see the Australian government's StudyAssist website.

This change will be automatically applied to all pays with physical pay date of 1 July 2024 or later.

Employee termination payments (ETP)

Employment Termination Payment (ETP) threshold amounts have changed for the 2024–25 financial year:

Life benefit termination payments ETP cap increases from $235,000 to $245,000.

For genuine redundancy and early retirement scheme payment limits:

The base limit has increased from $11,985 to $12,524.

The limit for each year of service has increased to $5,994 to $6,264.

This change will be automatically applied to all pays with physical pay date of 1 July 2024 or later.

Superannuation

Super guarantee

The compulsory superannuation guarantee rate increases from 11% to 11.5%.

Maximum super base contributions

The income per quarter increases from $62,270 to $65,070.

This is the maximum limit on an employee's earnings base for each quarter of any financial year. As an employer, you don't have to provide the minimum support for the portion of earnings above this limit.

These changes will be automatically applied to all pays with physical pay date of 1 July 2024 or later.

Child support deductions

From 1 January 2024 to 31 December 2024, the Child Support Protected Earnings Amount (PEA) are as follows:

Frequency | Amount |

|---|---|

Weekly | $514.50 |

Fortnightly | $1,029.00 |

Four weekly | $2,058.00 |

Monthly | $2,237.16 |

Unused leave on termination of employment

There are no changes to withholding rates on unused leave on termination for 2024–2025. For the current rates, see the ATO website.

Fringe benefits tax (FBT)

There are no changes to FBT for 2024–2025. For information on the current rates and thresholds, see the ATO website.

Wrapping up the 2023–24 financial year

MYOB Acumatica — Payroll automatically updates some rates and thresholds to keep you compliant. However, you need to manually set up fringe benefits and Single Touch Payroll Phase 2.

To get started with these procedures, make sure you complete and close all pays for the tax year being updated.

You must complete these procedures before closing your first pay of the new tax year.

1. Verify your data and system setup

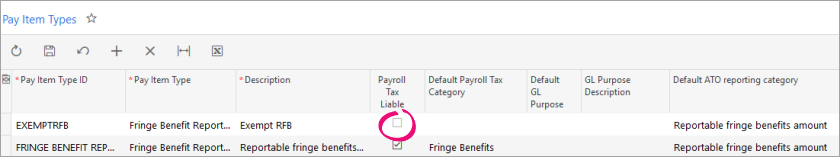

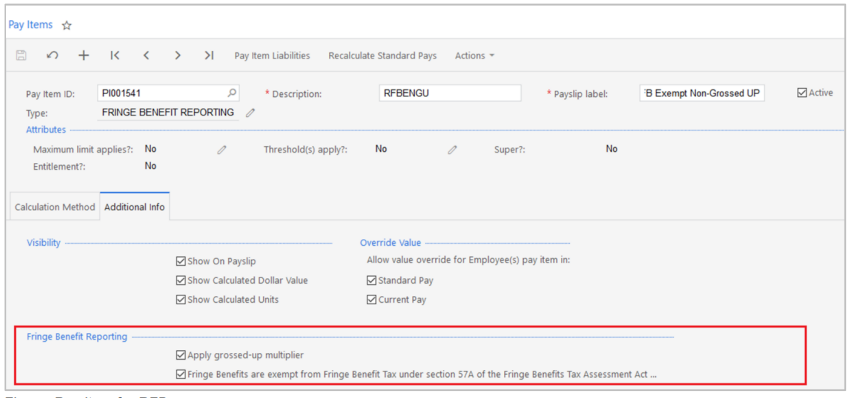

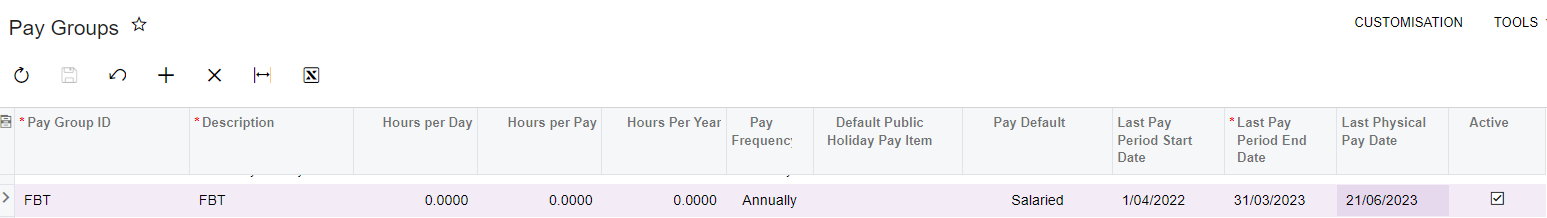

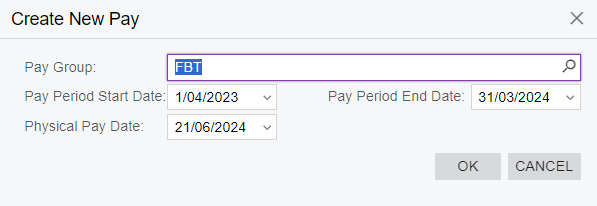

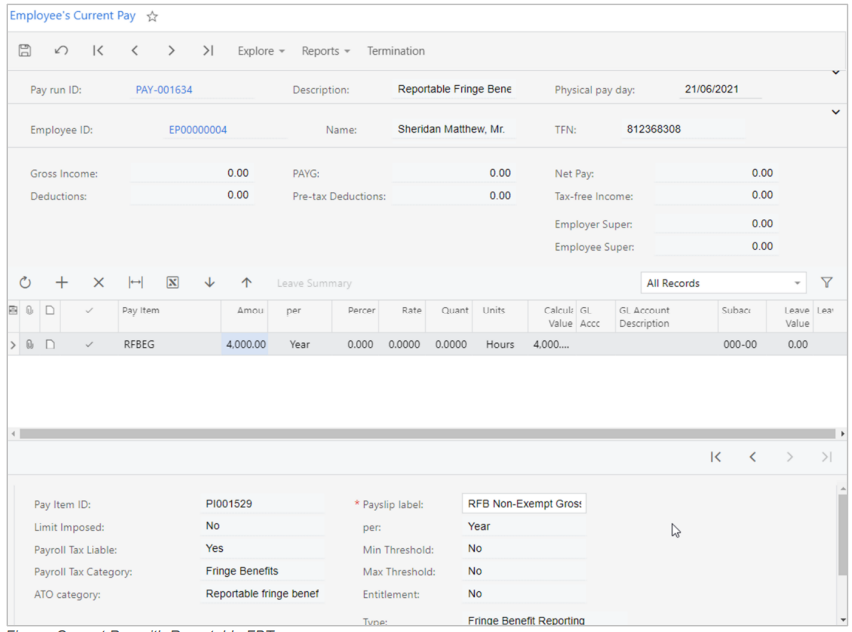

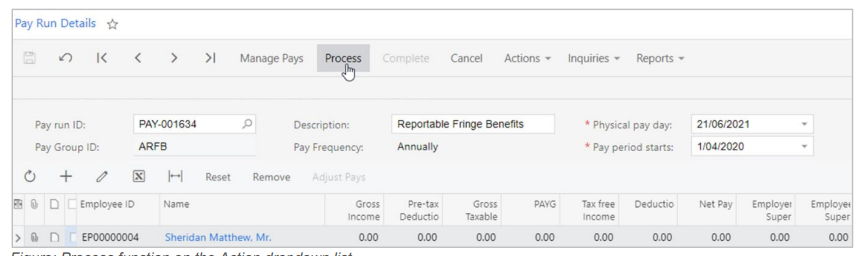

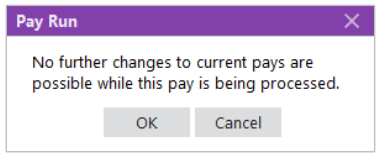

3. Reporting fringe benefits

If you have employees with reportable fringe benefits, you need to report these to the ATO via an STP pay event. This section explains how to:

Set up MYOB Acumatica — Payroll for reporting exempt and non-exempt fringe benefit payments.

Load reportable fringe benefits amounts.

Send the pay event data to the ATO after completing the reportable fringe benefits pay run.

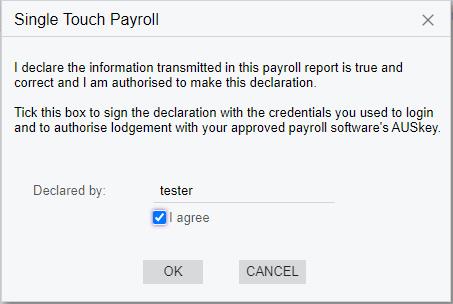

4. Finalise your STP reporting

The last step for end-of-financial-year procedures is to finalise your STP reporting. On the STP Finalise screen (MPPP5023), you can submit a finalisation event to the ATO. You must send your finalisation event for the current tax year before July 14 2024.

After finalising, your employees can access their information in ATO site to complete their income tax return.

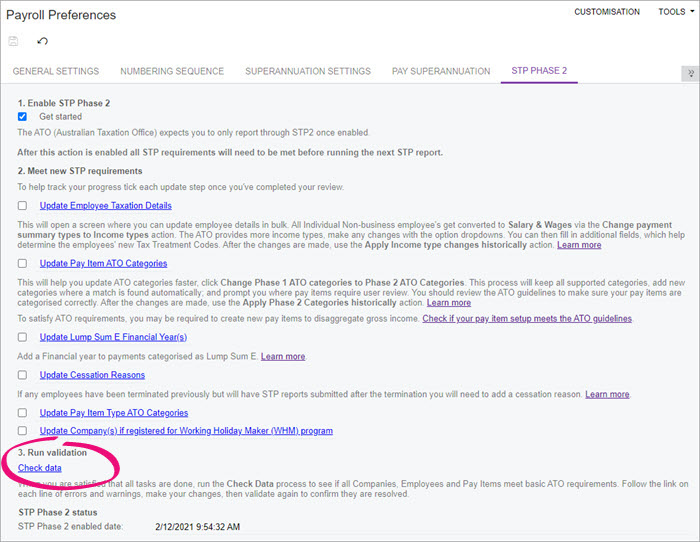

For more information about finalising your STP reporting, see Single Touch Payroll. These pages also cover the changes for STP Phase 2. All customers must use STP Phase 2 unless you have a deferral from the ATO.

If you're an employer with closely held payees, you can find more information on the ATO website.