2023.1.7 Release notes

For New Zealand companies, the 2023.1.7 release makes it easier to pay employees that can’t take annual leave for a company closedown. Previously, this involved a manual workaround.

Now, paying a company closedown amount is like making any other payment. All you have to do is identify the employees that should be paid, then add the new company closedown pay item to the employee’s pay. Everything else is handled behind the scenes – you no longer need to manually process entitlement adjustments or reset the annual leave trigger date.

We’ve also resolved issues identified in previous versions, including an issue affecting leave rates.

New features

To be able to use the company closedown features, you need to select the new Company Closedown checkbox on the Enable/Disable Features form.

If you disable the company closedown features, you can still view data from completed company closedown pay runs. Disabling the features just declutters your screens by hiding the extra buttons and checkboxes you don’t need for most of the year.

For detailed information on using these new features, see Company Closedown in the online help.

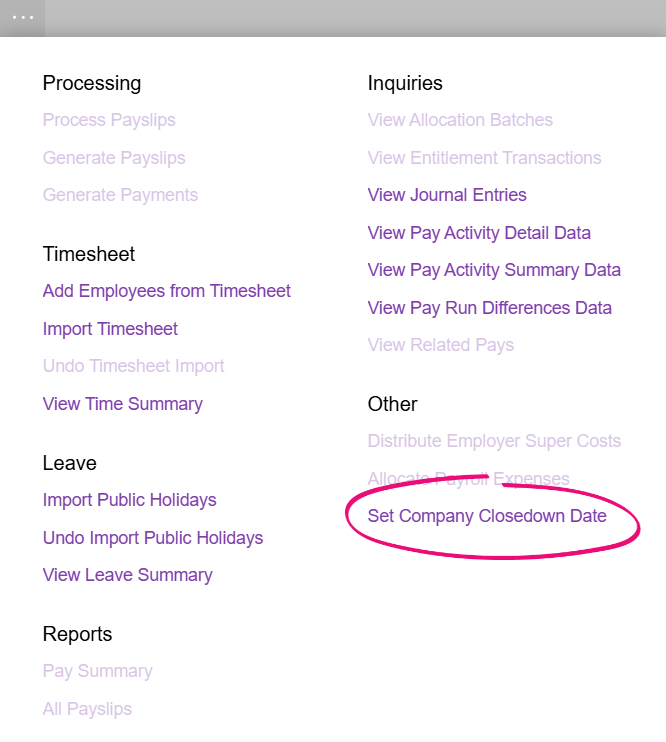

Company closedown date

You can set the company close down date in any pay run. This lets you add the new company closedown pay items to employees in that pay run.

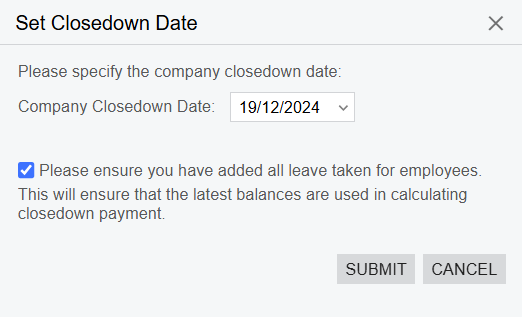

On the Pay Run Details form, click the three dots (…) and choose Set Company Closedown Date.

Then enter a date in the Set Closedown Date window.

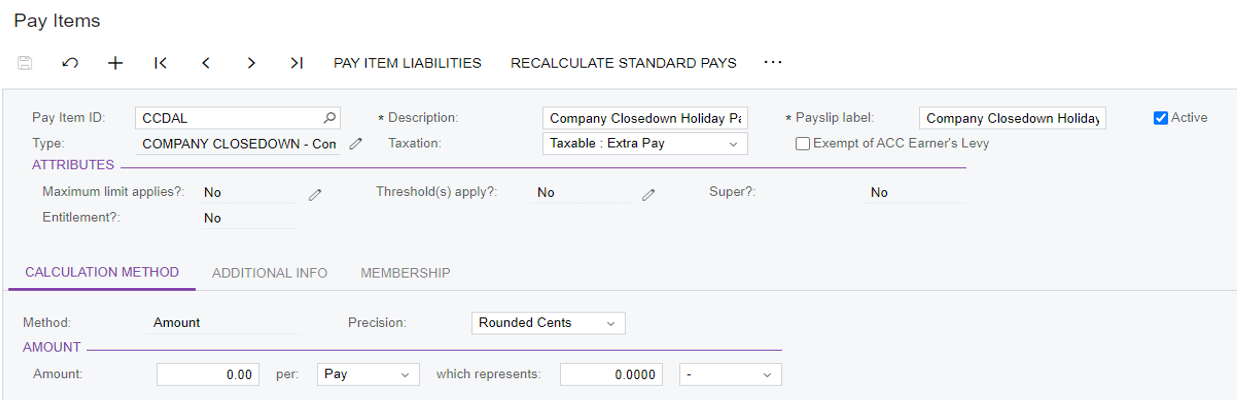

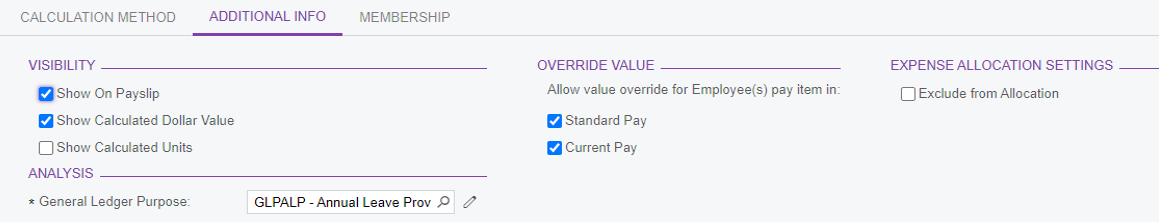

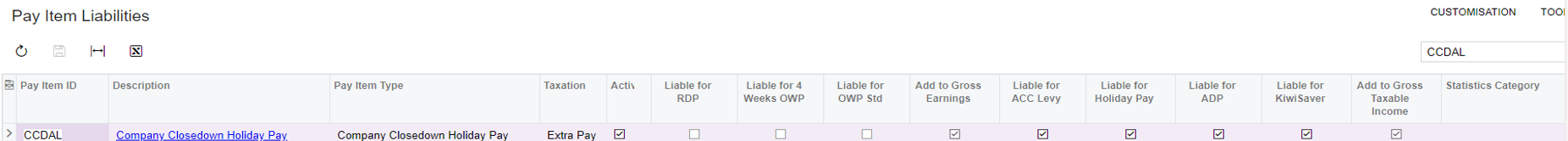

Pay item automatically calculates closedown payments

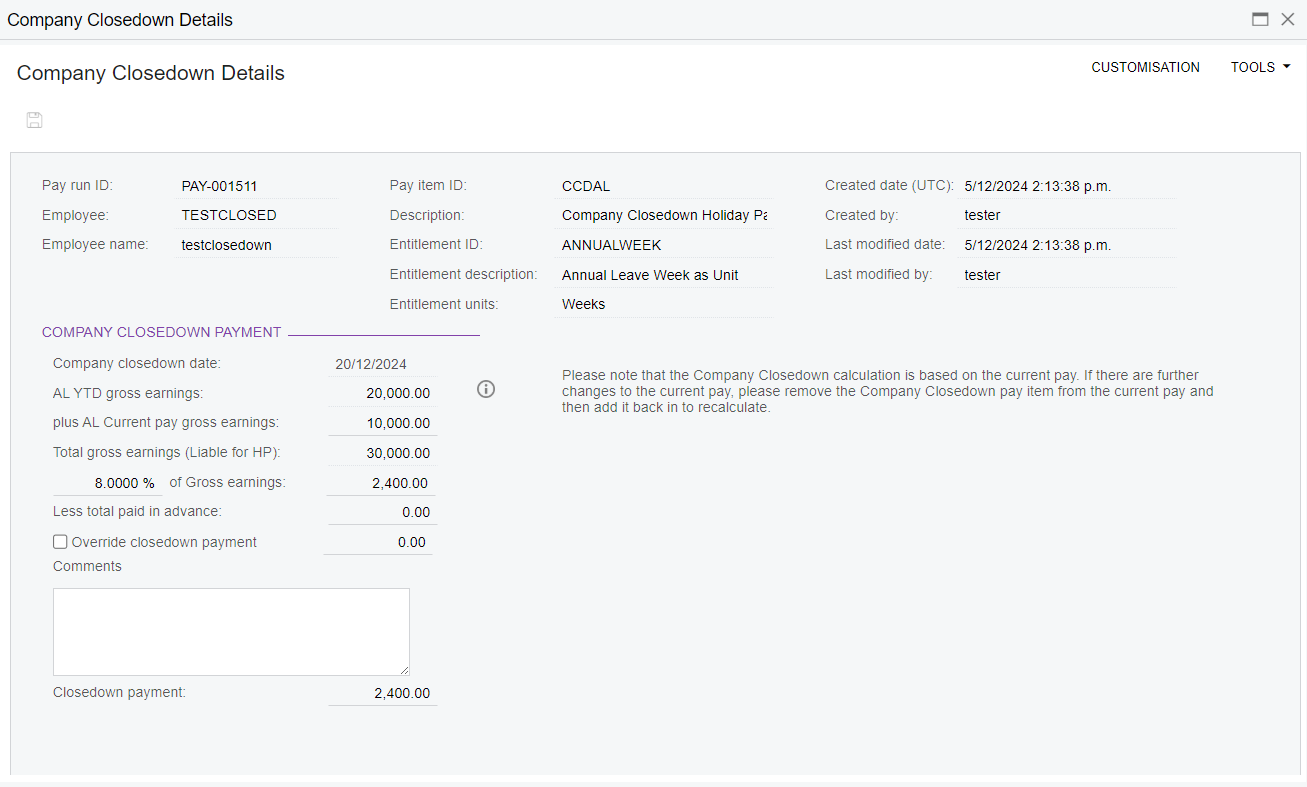

You can use the new CCDAL pay item for all company closedown payments – no matter if your company pays the standard 8% or if it pays more. There’s no need to edit the pay item or create a custom one.

When you add the pay item to an employee’s pay, the Company Closedown Details window shows you which values and entitlements were used to calculate the closedown payment. You can also manually change the payment amount by selecting the Override Closedown Payment checkbox.

Plus, the new pay item type – Company Closedown Holiday Pay – makes it easy to filter payroll reports for auditing and record-keeping.

Changing the annual leave payout percentage

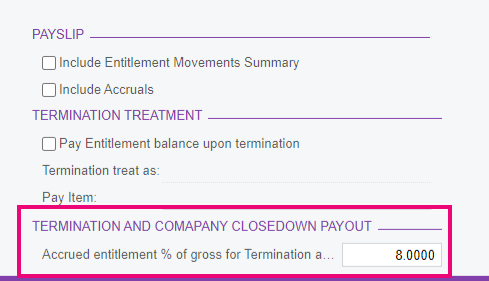

If your company pays more than 8% for closedown payments, you can easily change the percentage paid by editing the annual leave entitlement.

On the Entitlements form (MPPP3300), use the Accrued entitlement % of gross for Termination and Company Closedown field.

Resolved issues

MYOB Acumatica — Payroll

Region | Description | Reference |

|---|---|---|

NZ | On the Termination screen (MP.PP.54.00), the Less total paid in advance field wasn't including all normal payments taken in advance in the current open termination pay. This was because the wrong date was being used in the calculation. | N/A |

NZ | After importing leave into a pay run, an employee's average weekly earnings (AWE) and ordinary weekly pay 4-week (OWP) rates could calculate incorrectly – e.g. it could be 700 instead of 900, or it could be 0.00. This could cause an employee's annual leave to be underpaid. | CE00015660 CE00052198 CE00052199 CE00052503 CE00053226 CE00053809 CE00054069 CE00054669 |